Moving Between Canada and America: Comparison of Financial Accounts

Adam McHenry, CFA, MBA Portfolio Manager, Raymond James Ltd.

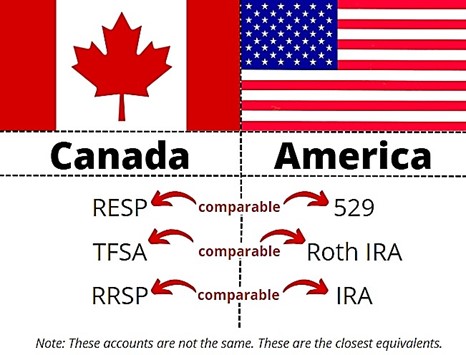

Relocating from the United States to Canada or vice versa can be both a thrilling and daunting endeavour. To facilitate a smooth transition, this article offers an in-depth comparison of Canadian and U.S. financial accounts.

Education Savings:

- U.S. Education Planning Account: 529 Plan

The U.S. offers residents the 529 Plan, a tax-favoured account promoting savings for future education costs. With the 529 Plan, you make contributions using post-tax income, allowing your investments to grow tax-free. The primary benefit surfaces when funds are used for eligible education costs, such as tuition, housing, and academic supplies. In these instances, withdrawals are free from federal tax, and often exempt from state tax.

- Canadian Education Planning Account: Registered Education Savings Plan (RESP)

Canada’s education equivalent is the Registered Education Savings Plan (RESP). RESP is a tax-advantaged account facilitating savings for children’s post-secondary education. Contributions to the RESP are post-tax, and the Canadian government supplements your savings by providing a Canada Education Savings Grant (CESG) that matches 20 per cent of your contributions, up to a limit of $500 annually. The investments grow tax-deferred within the account. Upon withdrawal for education-related expenses, the funds are taxed at the student’s income tax rate, which is typically lower than the student’s parents’ tax rate.

Tax-Free Investment Growth:

- U.S. Tax-Free Investment Growth: Roth Individual Retirement Account (Roth IRA)

The U.S. provides the Roth Individual Retirement Account (IRA) for tax-free investment growth. The Roth IRA accepts posttax contributions, and earnings along with withdrawals during retirement are tax-free, provided certain conditions are met. This tax-free growth makes Roth IRAs an ideal tool for long-term retirement planning.

- Canadian Tax-Free Investment Growth: Tax Free Savings Account (TFSA)

The Canadian tax-free equivalent is the Tax-Free Savings Account (TFSA). Unlike the Roth IRA, the TFSA isn’t exclusively designed for retirement, thus offering more flexibility. Contributions are made with post-tax income. Any income or capital gains generated within the TFSA remain untaxed, even upon withdrawal, making it an appealing option for a variety of financial goals due to its flexible withdrawal rules and tax-free growth.

Retirement Savings:

- U.S. Retirement Savings: Traditional Individual Retirement Account (Traditional IRA)

In the U.S., the Traditional IRA is a popular retirement savings account with tax advantages. Depending on your income and whether you’re covered by an employer-sponsored retirement plan, contributions may be tax-deductible, thus reducing your current taxable income. The investments within the IRA grow tax-deferred. Withdrawals in excess of nondeducted cost basis during retirement are taxed as ordinary income.

- Canadian Retirement Savings Account: Registered Retirement Savings Plan (RRSP)

In Canada, the retirement savings equivalent is the Registered Retirement Savings Plan (RRSP). The RRSP resembles the Traditional IRA, with contributions that are tax-deductible, reducing your current taxable income. The investments within an RRSP grow tax-deferred, optimizing the power of compound growth. However, similar to the Traditional IRA, withdrawals from the RRSP during retirement are taxed as ordinary income, presuming a lower tax bracket in retirement than during working years.

Other Considerations:

Currency fluctuations and tax considerations are significant factors to evaluate when moving across borders. Currency exchange rates can impact your investments’ value, and it’s essential to devise strategies to mitigate potential currency conversion cash and losses.

Understanding the tax implications of moving across borders is also crucial. The U.S. and Canada have a tax treaty to prevent double taxation of income, but not all accounts are treated equally. For example, while the RRSP is recognized in the tax treaty and can grow tax-deferred even if you move to the U.S., the RESP and TFSA may not receive the same recognition and could be subject to U.S. taxation on earnings.

Moreover, knowing the reporting requirements is essential. For instance, as a U.S. resident, you might need to report your foreign bank and financial accounts annually.

Final Thoughts:

Navigating the financial landscape when moving across borders can be complex. It requires understanding different account types, tax systems, currency considerations, and estate planning laws.

As a licensed cross-border financial advisor with two decades of experience, I specialize in simplifying these transitions. I offer expertise in both U.S. and Canadian financial systems, making your cross-border move as effortless as possible. For personalized advice tailored to your unique circumstances, don’t hesitate to reach out.

For all your cross-border financial planning and investment needs, reach me, Adam McHenry at 416-901-6500 or adam.mchenry@raymondjames.ca.