Are You on Track for a Financially Secure Retirement?

Adam McHenry, CFA, MBA

Portfolio Manager, Raymond James Ltd.

Navigating the path to retirement requires foresight and meticulous planning. Achieving financial security during your golden years is the reward for decades of dedication and hard work. For Canadians evaluating their retirement preparedness, this article outlines key insights and guidelines.

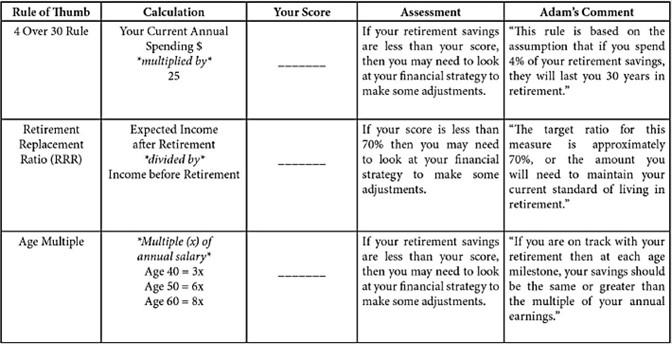

Start by envisioning your desired retirement lifestyle. Estimating current and future expenses will be central to your planning. The “4 over 30” rule is a helpful guide; it posits that your savings should last 30 years if you spend four per cent annually. Multiply your annual expenses by 25 to estimate the size of the nest egg you need.

Now, let’s discuss the Retirement Replacement Ratio (RRR). This is a vital metric, calculated by dividing your expected income in retirement by your income before retirement. A score of 70 per cent or more is usually considered adequate. For example, if you currently earn $100,000 annually and expect to have an income of $80,000 in retirement, your RRR is 80 per cent. If your RRR falls below 70 per cent, it may be a signal to reassess and make adjustments to your financial plan.

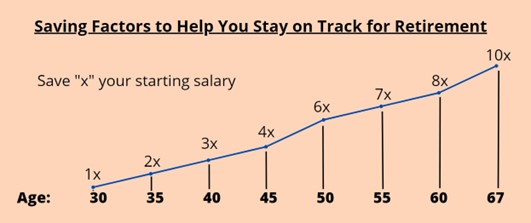

Another gauge of your progress is the age multiple guidelines, which suggest having savings equivalent to three times your annual salary by age 40, six times by age 50, and eight times by age 60.

Seek the counsel of a financial advisor. A seasoned professional can provide tailored advice and strategies, based on your unique goals and risk tolerance.

Lastly, regularly evaluate and adjust your plan. Adapt to life changes and keep abreast of economic trends.

In conclusion, financial security in retirement is an attainable objective with prudent planning, disciplined saving, and astute investing. Tools such as the “4 over 30” rule, Retirement Replacement Ratio (RRR), and age multiple guidelines should be part of your tool kit. Enrich your plan with knowledge of government programs and professional advice. Take charge of your financial future and cultivate the retirement you aspire to.

To create your very own personalized retirement plan professionally, contact me, Adam McHenry at 416-901-6500 or adam.mchenry@raymondjames.ca.

Raymond James Ltd. is a Member Canadian Investor Protection Fund. The views are those of the author, Adam McHenry, CFA, MBA, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. This information is general in nature, and is intended solely for the purpose of illustrating a general retirement guideline, based on various assumptions. Whether the guideline is appropriate and applicable for you will depend on your goals and your specific situation. Raymond James does not provide advice on tax, legal or mortgage issues. These matters should be discussed with an appropriate professional. Sources used when composing this article include Raymond James, Fidelity, Manulife, Investopedia, and Government of Canada website.