A TOUCH OF FROST #10 – The Value of Advice, Mag7 Profit per Minute & the Devil’s Brigade

The Value of Advice

Price is always something that comes up in this industry, and it will only get more serious with CRM3 on the rise. CRM3, short for Client Relationship Model Phase 3 (also called Total Cost Reporting or TCR), is a new set of Canadian regulations taking effect in January 2026. The goal? More transparency for investors.

Advisors will now have to show the total dollar amount of all investment costs each year, both direct and indirect. This means fees that used to be hidden inside fund performance, like Management Expense Ratios (MERs) and Trading Expense Ratios (TERs), will now appear clearly on your statements, starting in early 2027. However, advisors will also be promoting more services and plans to justify the price their clients pay, with clients receiving more value.

Canadian research has shown that ongoing advice enhances long-term savings1. Based on time frames, people with financial advice for 4-6 years have 2.7x the wealth than those without advice1. Those with advice for 7-14 years had 2.9x the wealth, and for 15+ years of advice, 3.9x the wealth of those without advice1. Advice and coaching make a difference that increases as times increases. Financial professionals do this through five main areas:

- Knowledge and experience

- Discipline

- Peace of mind

- Access to professional services

- Caring

Knowledge and experience

Advisors have plenty of knowledge through the many courses they have to take. Whether your advisor is a CFP, CIM, PFP, CFA, etc., they have committed to many years of continual learning to keep up with trends and regulations. Not only that, but teams of advisors (like The Frost Group) have over 20 years of experience in the industry. Having worked through different kinds of markets, working with different families, and seeing different scenarios, we are able to lean on knowledge and experience to provide extra value when needed.

Discipline

Leaning on our experience, we have gained discipline. Advisors like us help clients stay on track to meet changing goals, life events, and changing markets. We make sure that you aren’t chasing the hottest stock or trends/fads, but doing smart diversified investing. Past performance may not be indicative of future results, but by staying disciplined, we are doing our part in minimizing drawdowns.

Peace of mind

Building on discipline, knowing your investments are tailored to your risk tolerance and capacity would create peace of mind. Our goal is to help you feel confident in your plan, recognizing that all investments involve risk. Our philosophy is simple; the world, most likely, will not go bad at the same time. So, being equally balanced between Canada, USA, and international will cap downside risk, allowing you to sleep soundly. The ability to be protected when the unexpected happens can help make sure your family has peace of mind in the event of something bad, not only with investments, but also with insurance products.

Access to professional services

Raymond James Ltd. is a part of Raymond James Financial in the USA, which has approximately $1.73 trillion in client assets, roughly 8,900 advisors, and 151 straight quarters of profitability2. The best part? Raymond James Ltd. is the largest independent financial service firm in Canada, meaning we have no obligation to sell you anything. We get to work with the professionals we want to, not ones who will pay us. Whether it’s about products like mutual funds or ETFs, lawyers, accountants, realtors, or mortgage brokers, we have a developed network to help assist with personal and business needs. We are also required to suggest a minimum of three people, so that you can choose who you fit best with.

Caring

Finally, caring about our clients is a given but cannot be underestimated. Working collaboratively, as a team, over your finances helps us get to know every aspect of your life, from your family to work, to what causes you are passionate about. What we have found at The Frost Group is that people don’t care what we know, they want to know we care. So, that is our aim every day: show our clients that we care, over phone calls, in meetings, and in their plans and investments. Keeping them up-to-date on reviews, listening and asking questions, or even just organizing simple check-ins go a long way.

Our mission is simple: to deliver more value than cost. At The Frost Group, we’re committed to ensuring you receive the highest level of service and results, whether you’re a high-net-worth family or building your wealth for the first time. Research consistently shows that the value of advice far outweighs no advice and we’re here to prove that every day1.

1IFIC Advisor Insights – Advice Creates Strig Value for Canadians | CIRANO – The Gamma Factor and the Value of Financial Advice – Summary of Findings

2Raymond James Financial - https://www.raymondjames.com/about-us/by-the-numbers

What I’m Seeing and Reading

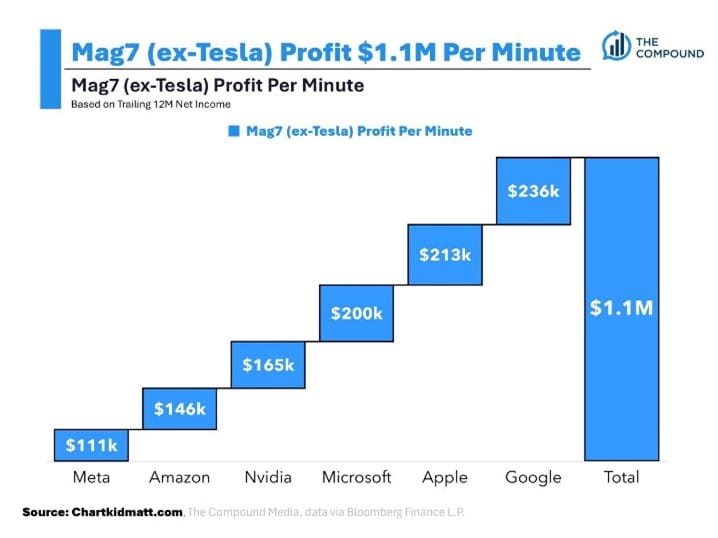

On the right, you can see just how insanely profitable the Mag7 stocks (minus Tesla) really are – $1.1 million per minute in profit. Say it slowly, one point one MILLION per MINUTE! For context, in 2024, RBC had $16.2 billion in profit, so their profit per minute was $30,821. Which means they need three minutes and thirty-six seconds to make what Meta would make in a minute.

Barrett, J. (2025, September 12). 42% of Canadians don’t have life insurance—are you one of them? MoneySense

- Over 40% of Canadians don’t have life insurance, while one in four aren’t confident their families will be financially secure if they suddenly pass or stop working.

Ben Felix – Investing 101

- This is a great introduction video for those just starting to invest or those who are curious about it.

Raymond James Ltd. – November is Financial Literacy Month

- November is financial literacy month and RJ posted a bunch of resources to help. Whether it’s differences between accounts or stats and stories to help show off the benefits of planning and advice, we are here to help clients learn and improve a skill not taught in school!

Chip-Ins From the Week – The Devil’s Brigade

The Devil’s Brigade, officially known as the First Special Service Force (FSSF), was a joint U.S.-Canadian commando unit formed in 1942 during World War II. They were the toughest of the tough, trained in Montana’s rugged mountains for skiing, parachuting, hand-to-hand combat, and stealth attacks. Their blackened faces and silent nighttime raids earned them the fearsome nickname, “The Black Devils,” from the Germans. The unit became legendary for their daring assault on Monte la Difensa in Italy, where they scaled a thousand-foot cliff under the cover of darkness, to surprise and defeat heavily entrenched German troops. That victory helped open the road to Rome and proved their reputation as one of the most effective fighting forces of the war.

Later, they continued their advance through France, liberating towns and striking so swiftly that German documents warned troops to “beware the Black Devils.” Though small in number, they earned more than 5,000 decorations, setting the standard for future elite units like the U.S. Green Berets and Navy SEALs. Their teamwork between American and Canadian soldiers also symbolized unity and shared sacrifice. Disbanded after the war, their legacy still lives on, recognized with the Congressional Gold Medal in 2015 and remembered as the original special forces, who turned impossible missions into history-making victories. Lest we forget.

Quote of the Week

“Price is what you pay, value is what you get.”

- Warren Buffett

Enjoy the weekend,

Jonny

Disclaimer: Information in this article is from sources believed to be reliable; however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. Raymond James advisors are not tax advisors and we recommend that clients seek independent advice from a professional advisor on tax-related matters. The views are those of the author, Jonathan Van Dam, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd adheres to. Raymond James Ltd. is a Member Canadian Investor Protection Fund.