A TOUCH OF FROST #1 – Working with Advisors, Buffets Last Year + WHL Playoffs

Working with an Advisor IS about planning a trip to Disney World

In my opinion, AI is a great TOOL, not an author. If you ask it to write a story, it will, but it won’t be very good. Formatting will be very copy-paste; follow the exact same template for each paragraph, which is not ideal. However, using AI for studying purposes or setting out a plan for marketing can be beneficial. This helps kickstart your brain and gives you something to build off of. Thus, bringing us to today’s topic, working with an advisor IS about planning a trip to Disney World.

I prompted AI with the following: “Give me a case scenario about achieving short-term goals like taking your family to Disney World while still saving for retirement. Give me details about the family, incomes, assets, debts, and expenses. Two adults in the family and two kids lives in Alberta, Canada. Both parents have jobs, modest jobs making average wages.”

Here is a summary of what AI gave me:

Working with a Financial Advisor should be more than just retirement goals, and with CCS (Certified Cashflow Specialist) advisors, they will focus on more. As for James and Sarah, they want to go to Disney World next August before the kids go back to school while adding to their emergency savings. So, I put their incomes, debts, assets, and expenses into our cash flow plan software and created a plan based on their short-term goals of going to Disney World and emergency savings.

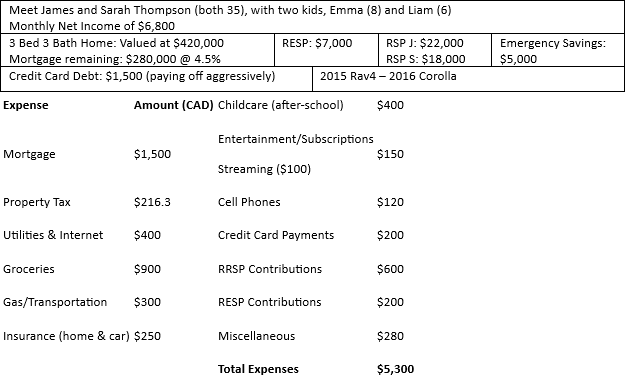

They are actually in a good spot debt-wise. The main debt is the mortgage, as the credit card is aggressively getting paid down. Furthermore, committed expenses are non-emotional and generally fixed/predictable. In the Thompsons’ case, they have $5,236. See the breakdown on the right.

As for the spendable amount, we are suggesting that the Thompsons spend $350 per week or $1,516 a month. These are for groceries, activities, morning coffees, and other unpredictable, volatile, and highly emotional expenses. We have left a grace buffer of $50, which allows for extra spending if something big comes up that you might forget about.

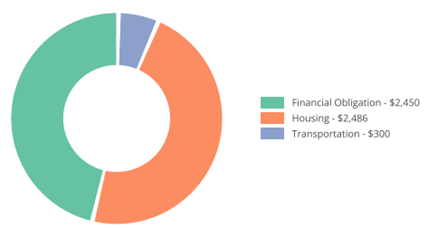

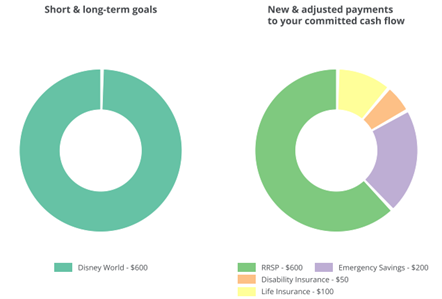

When inputting the Thompsons’ numbers, we found $997 of unconscious spending. With that, we put it to work immediately. While still doing their existing RSP amount, we also added $600 to a Disney World fund, gave $200 to the emergency savings, and added insurance, as we believe they are underinsured.

All in all, this cash flow plan will get the Thompsons ahead by at least $12,000 by August of 2026. With at least $8,000 for that family Disney World trip.

For a more detailed look at the plan, contact Jonathan.vandam@raymondjames.ca for a copy of the plan.

What I Am Reading and Seeing

Ben Carlson - Warren Buffett on Time Horizons - A Wealth of Common Sense

- Warren Buffet is stepping down after a life time at the helms drinking Coca Cola and eating McDoubles.

RBC and Financial Post -More than half of Canadians are feeling "financially paralyzed"

- Lots (55%) of Canadians are spending all their paycheques on necessary bills and expenses

Greg Valliere - Donald Trump — Serious or Not Serious? – AGF Perspectives

- Trump is great at making headlines, as we saw in April. Moreso, he can spin them on a dime

In the Money with Amber Kanwar – Why Raymond James CEO Jamie Coulter Isn’t Panicking

- CEO Jamie Coulter provides a valuable insight on how Raymond James is growing, and why volatility shouldn’t cause panic in a VUCA world

Chip-Ins From The Week

Well, Medicine Hat has bonded so much over this Tigers team; it is awesome to see. Everywhere you look, orange and black is running rampant. Whether it’s flags, window paint, cheesecakes, or drinks, Medicine Hat has Tiger fever. I have always believed that sports bring communities together, and this year is another example of it. This has been a great year for Medicine Hat and the Tigers Hockey Club. Medicine Hat is making their return to the WHL Final after 17 years, last winning the trophy in 2006-07. Friday at 7pm the WHL Championship begins.

Quote

Seeming as Buffet announced his retirement at the end of the year, here is a quote from him:

“I’m not recommending that people buy stocks today, tomorrow, next week, or next month. It all depends on your circumstances. You shouldn’t buy stocks unless you expect, in my view, to hold them for a very extended period, and you are prepared financially and psychologically to hold them the same way you would hold a farm and never look at a quote. You’re not going to pick the bottom and nobody else can pick it for you.”

Disclaimer

Information in this article is from sources believed to be reliable; however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Jonathan Van Dam, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member - Canadian Investor Protection Fund.