A TOUCH OF FROST #9 – Longevity Risk and Income Shortfalls, Facts and Fiction, and World Stats Day

Longevity Risk and Income Shortfalls

A CBC story from 2024 reads “Canada’s oldest age group is also its fastest-growing,” which comes from StatsCan finding that Canada’s population of centenarians more than tripled between 2000 and 2023. As of July 1, 2025, Canada is home to 12,281 people aged 100 or older1, compared to 3393 in 2000 and 1065 in 19712. Whether we want to or not, more people are living to 100+ at greater rates than previous generations. Now, it’s not super-common, but life expectancy across the board has increased too. The Organization for Economic Co-operation and Development (OECD) did a study on their member countries (Canada is one of the original founding countries) and found that if you were born in 2021, your life expectancy is 83 for women and 77 for men3. This is great news for us, as it shows we have made proper advancements in health care, mental and physical strength, and overall wellbeing, but it also comes with implications.

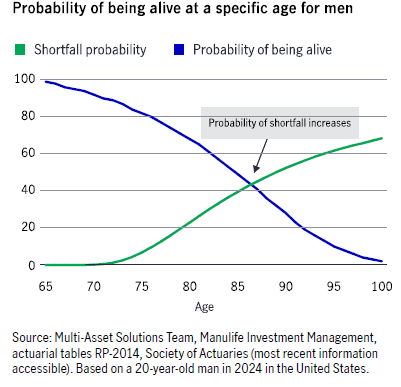

However, we don’t know how long we will live, and that causes a thing called “Longevity Risk.” In simple terms, longevity risk refers to the financial risk of living longer than expected and thereby outliving the nest egg you took decades to save for. In the age of Defined Benefit Pension Plans, no one thought of it because if you lived longer, the company cheques still rolled in. Now that more and more people are on the hook themselves, there is a void in this area of planning.

Let’s look at Alfred: he’s a 65-year-old man who worked as an oil field consultant and retired when his 65th birthday rolled around. Keep in mind, this is hypothetical and not predictive of actual outcomes; individual results may vary. His father made it till age 73, so Alfred assumed it would be the same for him, but added two years for “safe comfort.” Furthermore, Alfred figured that his $250,000 in RRSPs plus CPP and OAS would be enough to make it through the 10 more years. So, nothing was planned differently. The fact is that, in Canada, a male at age 65 today has a 75% chance of living to 80, 50% chance of aging to 86, and a 25% chance of reaching 924. That means, if he is the lucky person to make it to 86, that’s 11 more years of money he doesn’t necessarily have, creating a shortfall.

A study from Manulife (though The Frost Group of Raymond James Ltd. has no affiliation to Manulife) shows three things you can do while saving, to help decrease the odds of a shortfall while longevity risk increases.

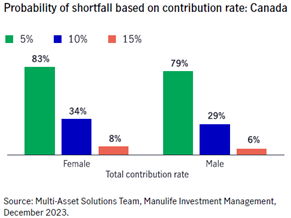

- Contribution rate increase (employer matches employee) (top right graph)

- Easier said than done. However, the study shows the probability of a shortfall decreases by 50% if you increase contribution from 5% to 10%5.

- Be cautious of your cash flow. If you need to pick up more debt to take care of day-to-day expenses because you have more contributions, that may not be the best situation for you. If you need help with seeing your cash flow, we can help.

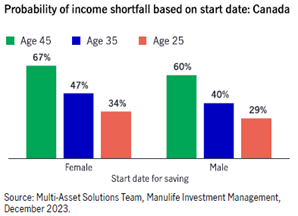

- Starting earlier for compound interest (middle right graph)

- As you start out in your career, make sure you get in the habit of putting your money to work, no matter the amount. The odds of a shortfall increase each year you wait.

- 50$ per month can compound to over $130,000 in 40 years, with potential for increases in contributions; compound interest works wonders.

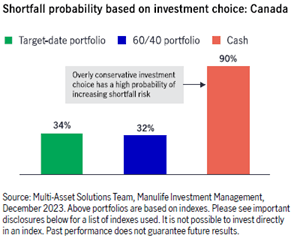

- Growth assets are critical for reducing shortfall risk (bottom right graph)

- The 60/40 portfolio (60% equities and 40% bonds) has the odds of a shortfall at 32% while cash (GICs, HISA, etc.) has a 90% chance of a shortfall5. Remember, past results are no guarantee of future results. No recommendation of any product or service would be made without a thorough review of an individual’s financial goals and risk tolerance.

- One of the biggest implications is risk, too much might not be comfortable and too volatile, but too little could leave you short in retirement and needing more.

Retirement income planning is a complex issue with no guaranteed win or strategy. These are just three things we can assist you in doing, to make sure that the fridge empties before your bank account. Everyone has differing levels of risk, money, and health challenges. At The Frost Group, we aim to get to know every part of your situation and see how we can implement different strategies of retirement income to reduce the odds of the shortfall and make sure you have the money for longevity. Whether it involves contributing more, starting earlier, having a custom portfolio aligned to your risk tolerance, purchasing an annuity, or delaying or taking CPP/OAS, we will look at your situation and see if it is suitable for you and your goals. If you want to check out our Retirement Income Guide to get a bit more in-depth information on all the parts to retirement income, email Jonathan.vandam@raymondjames.ca with “Longevity” in the subject line.

1 CBC News. (2024, June 25). Canada’s centenarians fastest-growing age group, Statistics Canada data show. https://www.cbc.ca/news/canada/british-columbia/canada-centenarians-fastest-growing-1.7246790

2 CBC News. (2022, May 1). Number of Canadians living to 100 hit a record high, new census figures show. https://www.cbc.ca/news/politics/canadian-centenarians-census-2021-1.6436494

3 OECD. (2024). Life expectancy: Society at a glance 2024 (full report). https://www.oecd.org/en/publications/society-at-a-glance-2024_918d8db3-en/full-report/life-expectancy_37a61588.html

4 Retraite Québec. (n.d.). Longevity risk. https://www.rrq.gouv.qc.ca/en/planification/risques-financiers-lies-retraite/Pages/risque-de-longevite.aspx?utm_source=chatgpt.com

5 Paquet, E., Kyrychenko, V., Sykes, R. E., Robertson, J., Browne, L., & Multi-Asset Solutions Team. (2025). Longevity risk: How longer lifespans affect shortfall risk in retirement planning. Manulife Investment Management. The Manufacturers Life Insurance Company.

What I’m Seeing and Reading

National Bank Investments - Facts & Fiction - Sept 30 2025

- CIO Martin Lefebvre posted about 13 investment beliefs and the actual fact behind them

- Building on previous blogs mentioning this study; see another one of them below:

Raymond James Ltd - Gold and AI, and rate cuts, oh my!

- Looking into October and what is to come, our investment teams see favourable terms for two more rate cuts in Canada and the U.S., plus with seasonal tailwinds, it makes for an exciting end to 2025.

Chip-Ins From the Week – World Statistics Day | Oct 20

Monday was World Statistics Day, which is celebrated every five years on October 20th. The UN created this holiday in 2010 to put a spotlight on the importance of stats and research. Being every five years, this means half a decade of stats about our lives are examined and discussed for better decision-making for the years to come. Here are some interesting and fun stats:

- As recently as 1965, bicycle and car production volumes were essentially the same, at nearly 20 million each per year. However, as of 2003, bike production climbed to over 100 million per year, compared to around 50 million cars produced that year.

- Elaboration of Worldwatch Institute data and Bicycle Retailer and Industry News – Statistics

- As of this writing (11:19 am on Oct. 20), there has been over 150,000,000,000 emails sent

- The current population of Canada is 40,241,189 as of Monday, October 20, 2025.

- LEGO bricks withstand compression better than concrete. An ordinary plastic LEGO brick is able to support the weight of 375,000 other bricks before it fails. This, theoretically, would let you build a tower nearing 3.5km in height. Scaling this up to house-size bricks, however, would cost far too much.

- Finally, The longest word in major English dictionaries is pneumonoultramicroscopicsilicovolcanoconiosis.

Quote of the Week

From the tag of one of my shirts:

“I don’t look at it as a gamble, really. I just look at it as a harder shot.”

- Arnold Palmer

Enjoy the weekend,

Jonny

Disclaimer: Information in this article is from sources believed to be reliable; however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. Raymond James advisors are not tax advisors and we recommend that clients seek independent advice from a professional advisor on tax-related matters. The views are those of the author, Jonathan Van Dam, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd adheres to. Raymond James Ltd. is a Member Canadian Investor Protection Fund.