A TOUCH OF FROST #5 – Win Rate of the S&P 500, Quarterly Coordinates, and the Difference Makers Golf Tournament

Win Rate of the S&P 500

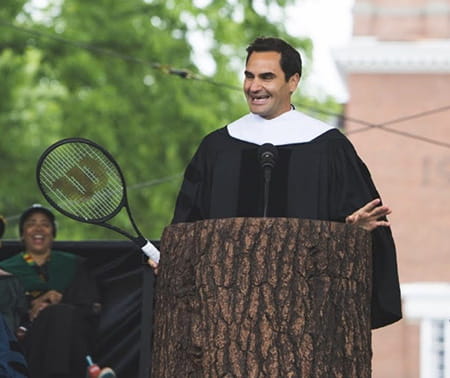

On Sunday, one of the most well-known tournaments came to a close, the Wimbledon Championship. Now, I am not a huge fan of tennis, but between this and something I saw on Instagram this morning, I was reminded about a crazy statistic that Roger Federer told students at Dartmouth’s graduation in 20241. He told students, “Being perfect in tennis is impossible…I won almost 80% of my matches… what percentage of points do you think I won in those matches? Only 54%.” Just 54%, let that sink in. Federer has won eight Wimbledon titles and is highly regarded as one of the best players ever, but he has only won 54% of the points in his matches. The points he did win would compound and eventually turn into a match win. Looking at those odds of 54%, he had better chances of getting a point than guessing heads or tails correctly, winning a hand of blackjack, or having a positive day on the S&P 500.

Comparing it to the stock market, we see that the percentage of positive days since 1927 is 52.4% of the time, while a loss on the day is 46.4% and having a flat day is 1.2%2. Think about that: over the past 98 years, the S&P 500 is flat or positive roughly 53.6% of time, just shy of Federer. How does this affect you? It’s simple, much like the points compounded into match wins for Federer, the stock market compounds and grows over time as well. Zooming out to look at returns over certain periods, we can see that the longer the holding period, the better the win rate. For example, we just said that for a day, for the S&P 500 to be positive or flat, there is a 53.6% chance. A month’s holding period increases the win rate to 64%, one year is up even more, to 79%, five years is 91%, 10 is 97%, and a 20-year holding period? Historically, the S&P 500 has not had a negative 20-year period. While long-term investing has historically yielded positive results, it’s important to remember that all investments carry risk, and past performance is not indicative of future results.

So, what does this actually mean for you? I think it highlights two main points:

- If Federer stopped playing after losing a point, he most likely wouldn’t be giving graduation speeches. Putting too many emotions into the day-to-day action in the market hurts your chance of building wealth in it.

- The minor wins in investing, like tennis, compound into bigger gains over larger time-frames. There is a reason why tennis matches aren’t subject to certain lengths of minutes, and that’s why your time horizon should always be longer and focused to utilize compound interest.

1Roger Federer’s commencement speech to the Dartmouth grads can be found here.

2This information was gathered by Ben Carlson and his blog, A Wealth of Common Sense. To read his blog, click here.

What We’re Reading and Watching

Raymond James Financial – Quarterly Coordinates 3Q25: Back to the Future: Lessons from the Past, Strategies for the Future

Stephanie Holmes-Winton – Total income doesn’t matter as much as total cash flow to retirees

- “It’s not what you make. It’s what you keep. That is true for all of us, but retirees who are no longer working don’t likely have a way to make more money to keep.”

Thomas William Deans – Every Family’s Business

- This book is a must-read for any business owner. It is an easy read as it tells business owners how not to sell a business, through a story of Tom on a plane ride. Here is our review of it: https://youtu.be/wVpQ7ghGgDM and if you want a copy, email vandam@raymondjames.ca with the subject “Family Business.”

Raymond James Ltd. - Gifting or Donating as an Attorney for Property

- “Across Canada, the POA is an essential tool for individuals who may become incapable of managing their financial affairs. […] This article explores the general principles governing gifting and donating via a POA in Canada.”

Chip-Ins From the Week – Difference Makers Golf Tournament and the Root Cellar

One of the best tournaments in golf takes place this coming week, and it is held in little old Medicine Hat. This year, The Frost Group is hosting the 11th annual Difference Makers Golf Tournament and we are supporting the Root Cellar in Medicine Hat. This tournament is so much fun, it’s a free day full of good times, golf, and food. The Root Cellar is a local charity organization that provides food and support to individuals and families in need within the Medicine Hat area. It’s a vital resource for those experiencing food insecurity, offering both emergency food services and programs to help people get back on their feet. They focus on providing fresh, nutritious food, often sourced from local donations, community efforts, and partnerships with other organizations. The Root Cellar isn't just about distributing food, it's about building a stronger, healthier community by ensuring that people have access to wholesome meals.

Quote of the Week

“How long are you willing to sprint when the finish line can’t be seen?” – Anonymous

Enjoy the weekend,

Jonny

Disclaimer: Information in this article is from sources believed to be reliable; however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. Raymond James advisors are not tax advisors and we recommend that clients seek independent advice from a professional advisor on tax-related matters. The views are those of the author, Jonathan Van Dam, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd adheres to. Raymond James Ltd. is a Member Canadian Investor Protection Fund.