A TOUCH OF FROST #4 – Retirement Is More Complex, How an Advisor and a Plan Can Help, the Risk Inverse & Dominion Glass Factory

Retirement Is More Complex, How an Advisor and a Plan Can Help

Fidelity just released their 2025 Retirement Report, and though The Frost Group of Raymond James Ltd. has no affiliation to Fidelity, the report highlighted that retirement remains a huge challenge for many and is seen as more complex than ever before.

Compared to 2005, 91% of pre-retirees feel as though retirement is more complex, both financially and otherwise. Nowadays, retirement is different in regard to greater support for the next generation, flexible work arrangements, or just higher cost. Around 84% of people who are already retired say retirement is more complex and unique! This complexity has partially fed into the retirement income needs, as pre-retirees think they need an annual household income of $1,020,000 in today’s dollars (Bowen, Munro, & Power, 2025). This far outpaces inflation-adjusted result of $685,000 from the 2005 survey. There is a possibility that Canadians realize that longevity risk – outliving the amount of savings you have – is far greater now than it was in 2005, as humans are living longer than before.

Pre-retirees believe they’ll need $1,020,000 annually, but how confident are they? Among retirees, 81% feel positive about retirement—up from 2024 but slightly below the post-2015 average. In contrast, only 59% of pre-retirees feel optimistic, down nearly 20% since 2015. With 91% saying retirement is more complex, it’s no surprise that confidence is slipping.

One way to take on complexity is to be prepared; while complexity concerns grew among pre-retirees, financial preparedness has dropped. To me, this makes sense: as the complexity grew, positivity towards retirement sank, and ultimately, the level of preparedness continuously dropped. Only 49% of pre-retirees feel prepared financially for retirement (Bowen, Munro, & Power, 2025).

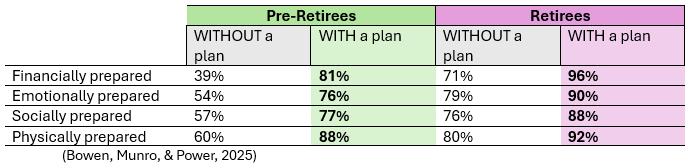

Now, planning for retirement does not guarantee retirement will be easy, perfect, or calming, but it does ensure some peace of mind, according to respondents. Respondents with a financial plan are 42% more prepared than ones without, because working with an advisor means you are more likely to start saving early, which leads to investing and planning towards the desired retirement lifestyle, and you are less likely to not be taking any steps to prepare for retirement.

The results of having a retirement plan by working with an advisor?

The numbers speak for themselves. Planning for retirement brings peace and helps uncover some of the uncertainties that retirement presents. This leads to less stress and worrying about the “what ifs,” which is why people with a plan are more likely to feel more prepared emotionally, socially, and physically. However, not all uncertainty can be covered in a plan, they call them surprises for a reason; but with diligent planning and open conversations, working with an advisor can help create a more prepared outlook and execution of your retirement goals.

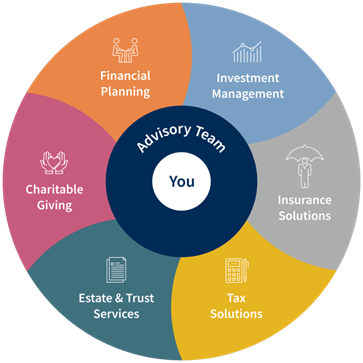

At The Frost Group, we aim to support your retirement from every angle. Whether it’s planning conversations, account options, or tax coordination with your accountant, we’re here to help. For those seeking income stability, we also offer access to insurance-based solutions—such as annuities—that can provide guaranteed lifetime income. These guarantees are backed by the issuing insurance companies, not by Raymond James or The Frost Group, and are subject to the claims-paying ability of the insurer.

Peter Bowen, Michelle Munro, Jacqueline Power (2025). 2025 Fidelity Retirement Report. Fidelity Canada.

What We’re Reading and Watching

Raymond James Financial – The Risk Inverse: Why – despite what you might think – more money means more planning

- You might assume that risk goes down as wealth goes up. Logically, having the means should mean less danger, more confidence, fewer worries. But risk likes to do the last thing you expect.

John Manganaro - How Raymond James Spends $1B a Year on Tech, With Advisors in Mind

- John sat down with the Chief Information Officer at Raymond James Financial, to discuss how $1 billion seems daunting, but he breaks it down into three pillars.

Walt Disney – Scrooge McDuck and Money

- This is a classic. Produced in 1967, way before my time, Uncle Scrooge takes his nephews through the history of money, how it works, and the power it can hold, all in a humorous and enjoyable way.

Chip-Ins From the Week – Dominion Glass Factory

If you've ever driven along the Trans-Canada Highway past Redcliff, over the last 70 years, chances are you noticed the two towering smokestacks rising from the heart of the town. They belonged to Dominion Glass, a Montreal-based company that, like many others in the early 1900s, was drawn to the region for its plentiful and affordable natural gas. In 1913, Dominion set up shop in Redcliff and began producing everything from bottles and jars to lantern globes and prescription glassware.

The smokestacks weren’t part of the original plant, as they were added during a major expansion in the 1950s. My great-grandfather, after immigrating to Canada, painted the insides of those very stacks before quitting because “dangling on a side of a building to paint is nonsense when I have a family at home.” His daughter, my grandmother, later worked in the glass factory too—because, as they said back then, the brick plant "wasn’t for girls."

The factory eventually closed its doors in 1989, later transforming into a fibreglass insulation facility. Today, the smokestacks are gone, but their legacy remains. For many in Redcliff, including my own family, the memories, the smell, and the stories passed down are still very much alive.

Quote of the Week

“The beginning is mostly luck. The end is mostly choices.” – James Clear

Enjoy the weekend,

Jonny

Disclaimer: Information in this article is from sources believed to be reliable; however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. Raymond James advisors are not tax advisors and we recommend that clients seek independent advice from a professional advisor on tax-related matters. The views are those of the author, Jonathan Van Dam, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd adheres to. Raymond James Ltd. is a Member Canadian Investor Protection Fund.