A TOUCH OF FROST #6 – How To Be Wealthy; Don’t Be Scared of Heights & Alberta Fun Facts

How To Be Wealthy

True wealth is about having the freedom, time, and means to easily and routinely, access those little experiences that bring joy to your life. No matter where you are or how much money you have, I believe that wealth encompasses more than just monetary values in your TFSA or RSP; though having higher monetary values can help, it is not a requirement.

There really are six steps in becoming wealthy.

- Have a Road Map

Around 96% of people with a financial plan feel confident about reaching their financial goals1. Getting started on it maybe hard, but everyday we have mini plans we follow. From getting dressed, to making breakfast, to even driving to work! Plans are apart of our everyday lives. This is the foundation to becoming wealthy.

- Your Ideal Saturday

This is probably the most important step. To really get an idea of what the road map encompasses, we look at your typical Saturday. What do you do for fun on Saturday, who do you see, what do you eat, how do you get there? These are all going to 6x in retirement because everyday becomes Saturday. Knowing and having an idea on how you want to retire will help you understand limits and goals to aim for in the road map. If being a snow bird is important, lets figure out a way to do it in your road map.

- Spend Less | Own More

Unconscious spending has gotten worse for all of us, and it can potentially cause a detour in your path. Considering how easy it is to tap a debit or credit card; debts can pile up and now 31% of Canadians say they carry too much debt2. Having 3-6 months’ income as an emergency fund while having good debt repayment strategies will help in spending less. Owning more and having a good net worth that doesn’t include your house is also important. While houses can be considered an investment, you can’t pay for groceries with a doorknob.

- Safeguard Your Greatest Asset

Insurance is never a fun conversation, but it is an important one. People always ask “What’s the point of insurance if I never use it or get the money?”, We then respond with “You don’t plan on getting into a car accident, but you have car insurance” or “You never think your house will catch on fire, or a pipe will burst, but you have home insurance in place just in case.” Life insurance, critical illness, and disability insurance is the same thing, protecting what you can’t afford to lose: yourself. The essence of insurance is protecting the greatest asset you have - your family.

- Keep More of Hard-Earned Money

Minimizing taxes through government approved tax planning tools like RSP’s, TFSA’s, FHSA’s, trusts, and Insurance contracts allows you to keep more of your hard-earned money. It is important to note that each tool may not be suitable for all clients, and they require personal advice and planning. When you minimize taxes efficiency and legally, you allow for prosperous transfers and spending of wealth in retirement. Not to mention, charitable giving strategies can help reduce taxes owed, regardless of tax bracket. “Remember, no one has ever become poor by giving” - Anne Frank.

- Know Your Values

How do you envision yourself in retirement? Are you the type to spend time volunteering or giving back to the community? Are you looking for a bridge club to join to have community in that way? Or are you happy being there for your grandkids? These are all driven by what you value, and knowing what you value will help with the other five points we discussed. Think about it this way, not everyone will be a multi-millionaire, and that is okay because they get to spend loads of time with their family. Maybe you have been able to accumulate millions, and you really value the hard work the food bank does, so you volunteer and donate immensely. Knowing your values and implementing them into your life and retirement is super beneficial on the way to a wealthy life.

12024 Schwab Modern Wealth Survey Shows Increasing Financial Confidence From Generation to Generation and Younger Americans Investing at an Earlier Age

- The online survey was conducted by Logica Research from March 4, 2024, to March 18, 2024, among a national sample of 1,000 Americans aged 21 to 75. An additional 200 Generation Z Americans completed the study. Quotas were set to balance the national sample on key demographic variables.

2Financial Consumer Agency of Canada - Canadians and their Money: Key Findings from the 2019 Canadian Financial Capability Survey

What We’re Reading and Watching

Raymond James Financial - The art of giving what you can't take with you

- When someone passes, money distribution is always top of mind. However, sometimes, there is more than money to give. If you are a collector of art, cars, watches, or hockey cards, distributing these can be messy if it is not accounted for in the will. Estate planning should be done in consultation with legal professionals.

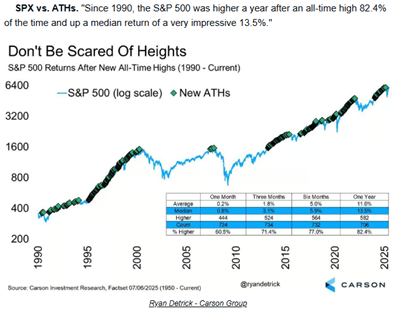

Ben Carlson - Not All Stocks Recover Their Losses

- History shows that the market seemingly always goes up. However, stocks have a different story. Some stocks haven’t recovered to all-time highs even as the stock market has. This is a big risk when picking individual stocks.

Raymond James Financial - Equity markets continued to climb higher in July

- Signs of market fatigue and elevated expectations suggest that caution may be warranted. The market did end the month up 2.17% fueled by a trifecta of earnings resilience, optimism around trade negotiations and the passage of President Donald Trump’s “One Big Beautiful Bill.”

Chip-Ins From the Week – Alberta Facts You Maybe Never Knew

This article has 24 facts; these are the facts that I didn’t even know

- There is a natural geological formation in Alberta called the Badlands Guardian, which looks like a Native American head.

- The Caesar Cocktail was created in 1969 by Walter Chell a restaurant manager at Caesar’s Steakhouse!

- Alberta is home to the world’s largest beaver dam, which is visible from space.

- Alberta is home to six UNESCO World Heritage Sites, more than any other province or territory in Canada.

- Canadian Rocky Mountain Parks

- Dinosaur Provincial Park

- Head-Smashed-In Buffalo Jump

- Waterton Glacier International Peace Park

- Wood Buffalo National Park

- Writing-on-Stone Provincial Park

Quote of the Week

A snippet from Seth Godin’s Blog:

“Of course, we make strategic errors all the time. […] Sticking with our original error, devoting our savings, well-being and future to proving ourselves right–that’s the real error. Don’t invest in the cover up. After you make a strategic error, announce it. Own it. And then move on.”

Enjoy the weekend,

Jonny

Disclaimer: Information in this article is from sources believed to be reliable; however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. Raymond James advisors are not tax advisors and we recommend that clients seek independent advice from a professional advisor on tax-related matters. The views are those of the author, Jonathan Van Dam, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd adheres to. Raymond James Ltd. is a Member Canadian Investor Protection Fund.