A Touch of Frost #7 - Funding the Future with RESPs

Funding the Future With RESPs

School starts in a couple weeks; think about how fast summer flew by. Seems like it was just a week ago that we had our Difference Makers Golf Tournament and the days were as long as ever. I even had a thought that it smelt like fall outside. Many families are gearing up to send their kids back to school. Backpacks, lunch kits, glue sticks, and markers are flying off the shelves. One cohort people may not think about is post-secondary students. As young families stock up on crayons, they may not be thinking of post-secondary education but it is something that can cost more than all the crayons they’ve bought over their school years.

Average tuition in Alberta in 2023/24 was $7,586, with an average increase historically of 2.67% since 2006. In 18 years? The cost is projected to be $11,4001. However, that’s for one year of tuition. If the kid moves away, or even goes for their masters, costs will, for sure, exceed over $80,000. With all this in mind, I prompted AI with the following, “Give me a scenario based off the following shared pdf about a family trying to save up for their newborn’s education. They live in Alberta and have a net family income of 75k. They are hesitant to start saving, as they also are planning on having other kids. They are set on keeping aside 200 bucks a month towards an RESP. They have also considered just doing it in a normal savings account.”

Meet the Martins. Tyler and Sarah live in Lethbridge and just welcomed their first child, Emma, a couple of months ago. The couple met in post-secondary and highly value the education they received. Knowing this, they want to make sure that Emma has the same opportunity they had, to go to post-secondary and follow her dreams. Being a younger couple, they make $75,000 after tax and are sufficiently covering day-to-day expenses with a new baby. Looking at their goal, they believe setting aside $200 will be a great starting point for Emma and any other future kid they may have. The issue? Do they utilize RESPs or just do a high-interest savings account at the bank? And should they start now or wait till they have another kid?

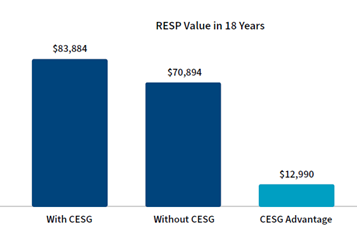

Do they utilize RESPs or just do a high-interest savings account at the bank? Comparing an RESP to a normal savings account, the benefits are clear. You can have any type of investment in an RESP while getting tax-deferred growth out of the product. On top of that, with an RESP, being a Canadian citizen and having a valid SIN, the child is eligible for the Canadian Education Savings Grant. This boosts savings, as it gives the RESP an additional 20% of contributions up to a max of $500 a year and $7,200 a lifetime.

Comparing an RESP to an account, with the Martins’ $200 monthly contribution, and starting it now, they can have around $83,884 with a 5% return. If this was just in an account, it would have made only $70,894. The difference isn’t the 5% or the contributions. It is the additional grant money that compounds as well.

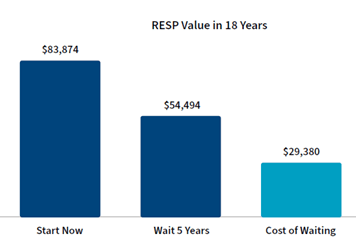

Should they wait now or till they have another kid? Waiting would be very costly to Emma’s future. Waiting five years because they may be more settled or established, could cost $29,380 roughly. Which, when reflecting on total future costs, is two years of tuition with room and board.

After reviewing the numbers, Tyler and Sarah realized that the RESP isn’t just about “saving money”—it’s about maximizing government grants and giving their investments more time to grow. Even with future kids, they can later adjust contributions and set up family RESPs that benefit all children, but by starting now with Emma, they avoid missing out on thousands in free grant money.

If are thinking about opening an RESP, have any questions about how it may affect your finances, or want your own copy of an RESP report, email Jonathan.vandam@raymondjames.ca with the subject line, “Future Funded.”

1FreshPlan, July 12 2024. Preparing Our Children for Tomorrow. Education Planning. Infographic.

What We’re Reading and Watching

Mind Your Farm Business - Ep. 107: No will, no plan, big trouble: Breaking the silence on succession

- “In this episode of the Mind Your Farm Business podcast, Shaun Haney is joined by estate planning expert and bestselling author Dr. Tom Deans to discuss why avoiding conversations about succession, wills, and wealth can lead to disastrous consequences for farm families.”

Stephanie Holmes-Winton - What clients really think about buying life insurance

- Stephanie talks about the common misconceptions about life insurance with clients and prospects.

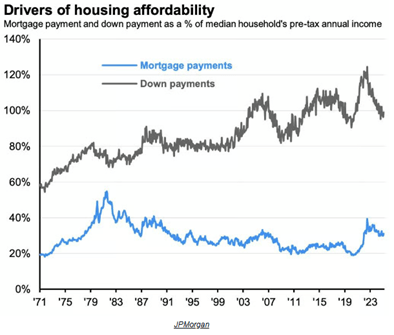

FP Posthaste – Mortgage Debt Appears To Be on the Decline

- This article discusses how many young Canadians have reached out to the Credit Counselling Society and how these young Canadians’ mortgage balances have been dropping while other generations’ have been rising.

Chip-Ins From the Week – Pickleball

I finally got a pickleball set the other day. I played it a handful of times in gym class way back when, and then it became cool? Yeah, I’d say cool. Everyone seems to play it, young or old, so much so that 19.8 million people play in the USA. 19.8 MILLION. That is not far off of half of Canada’s population. Not only that, but the biggest age cohort isn’t what you think. Representing 28.8% of all players, 25-34 is the largest age bracket playing the sport. While this may have been an older sport a few years ago, the growth rate has been around 311% and continued to grow at 11.4%1. This has been a craze that swept across the nation and world very quickly. Who would have thought? Now, you can play pickleball at 16,289 dedicated areas in the USA, that is over half of the private dwellings here in Medicine Hat. Imagine if all of the houses in Riverside, Crescent Heights, and Ranchlands turned into pickleball courts. Insane!

1Brandon Mackie. Feb 19 2025.Pickleheads. https://www.pickleheads.com/blog/pickleball-statistics

Quote of the Week

“Here’s the kicker: good days, repeated over and over, quietly built the kind of life “great days” never could. So, if you’re chasing greatness, maybe take your foot off the gas just enough to keep moving without flaming out. Build the life you want on “good enough” and watch how it compounds.”

- Trevor Moore

Enjoy the weekend,

Jonny

Disclaimer: Information in this article is from sources believed to be reliable; however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. Raymond James advisors are not tax advisors and we recommend that clients seek independent advice from a professional advisor on tax-related matters. The views are those of the author, Jonathan Van Dam, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd adheres to. Raymond James Ltd. is a Member Canadian Investor Protection Fund.