A TOUCH OF FROST #3 – The Herd During Liberation Day + Uncertainty for Months To Come & Memorial Cup Runner Up

The Herd During Liberation Day

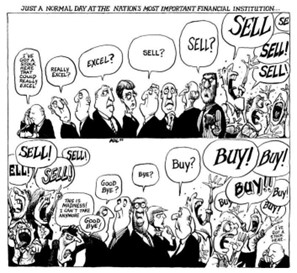

I found this cartoon a couple months ago and thought it was funny and very relevant to this industry. I figured somewhere, sometime, I would be able to use it for social media, to discuss a particular event where herd behaviour was present. Looking back to “Liberation Day” and the proceeding drawdown and bounce-back, I figured this cartoon fit perfectly. Let me explain.

Herd behaviour happens when a group of individuals act together in the same way without any centralized route. In the cartoon, we see someone say, “I’ve got a stock that could really excel,” that after going through many people, turns into everyone yelling “sell.”

However, tides shift when someone becomes annoyed by this “madness.” They say “good-bye,” and before you know it, everyone is yelling “buy.” You can see in the bottom corner that this cartoon actually keeps rotating around, and never ends. For all the people yelling “sell” or “buy,” investors may be influenced by emotional responses such as fear of missing out, which can lead to reactive decision-making. Thus, bringing us to Liberation Day and the following days of uncertainty and herd behaviour.

On April 2, the universal baseline tariffs and reciprocal tariffs on each nation were announced. In hindsight, what happened next isn’t too shocking. Over the next four trading days (April 3,4,7,8), the S&P went from ~5673 at close on Apr 2 to ~4974 at close on Apr 8. People sold America, based on the policy of tariffs and the expenses that come with them, and panic selling swept in. Being in the herd of sellers on Apr 8, everyone and everything seemed gloomy. Just like the cartoon, something flipped (the announcement of a 90-day negotiation period) and excitement rose. On April 9, we got a 10% gain and things began to look bright again… if you were able to buy the dip or stay invested.

What would happen to the selling herd that sold at the bottom and missed April 9? Well, according to Ben Carlson, as of May 14, the S&P 500 recovered and closed 0.7% YTD, and the herd follower who sold and missed out on Apr 9, would still be down -8.1% YTD. Yikes.

This isn’t the first time herd behaviour ran through the market (think of the dotcom bubble, the great financial crisis, and more recently, the GameStop mayhem in 2021) and it certainly will not be the last. It is human nature to run with the crowds, we want to feel connected and the same as others around us. When there is a predator, people start running, and you do too. Sometimes, we need to find leadership in others in times of uncertainty and this was very evident in the “Liberation Day” aftermath and could continue to be true.

To avoid herd behaviour, you could do your homework on the particular situation or company and diversify your portfolio. So, when one region or sector is hit hard, the others might be flat or excelling, and you can stay disciplined by sticking to your plan and think long-term. We recommend the last two and if you need anymore help, we are always happy to sit down with you and review your strategy.

I will leave you with this: according to a 2017 study by the CFA Institute, investors influenced by herd behaviour during market downturns were more likely to panic sell, resulting in poorer long-term performance, compared to those who maintained a disciplined investment strategy. (Nam Nguyen, The Decision Lab, Jul 3 2024)

What We’re Reading and Watching

Greg Valliere - Uncertainty for Months to Come

- The Trump administration has their hands full with plenty of uncertainty. Between Russia, the Big Beautiful tax bill, and now (even more than before), trade tariffs, the only certain thing? Trump will continue to keep everyone on their toes.

Brian Feroldi, Brian Stoffel, & Brian Withers - Long-Term Mindset - A Crazy Statistic

- Research found that the median (the middle point of a set of data) retail investor spends 6 seconds reading about risks of a stock, 54 seconds looking at fundamental information, and 3 minutes 24 seconds analyzing the price trend in the last few days.

Andrew Chang – Is Alberta the economic engine of Canada? – CBC News

- This topic almost always comes up at provincial and federal elections, so is it true? Andrew breaks down the biggest contributions versus the rest of the provinces on many different levels.

Chip-Ins From the Week – Memorial Cup Runner-Up, Medicine Hat Tigers.

It has been quite the year for the Medicine Hat Tigers. Ranked #1 in all of the CHL at the start of the year, the team battled injuries and shakiness at the start of the year, and finished the year with a dominate record, going 16-2 in the league play-offs, and a 54-game point streak by Gavin McKenna. There are lots of positives from this team but the drought continues as the Tigers lost to London in the Memorial Cup finals 4-1. However, this year was still nothing but spectacular. Though they didn’t win the Memorial Cup, they still won the league championship, and made Medicine Hat bleed orange like it hasn’t in quite a number of years. The amount of orange and black I saw around town was awesome, sports can really make people bond. Just even look at the team, they got so close you could see it in the way they played and interacted with each other and the fans; we had a special team this year. Who knows what will happen this off-season with graduating players, drafted players, and the NCAA snagging players. I do hope that this Tiger fever bleeds into next year because it is awesome to be a part of!

Quote of the Week

James Clear wrote this in his weekly newsletter, 3-2-1 Thursday:

"To improve, compare little things: marketing strategies, exercise technique, writing tactics.

To be miserable, compare big things: career path, marriage, net worth.

Comparison is the thief of joy when applied broadly, but the teacher of skills when applied narrowly."

Enjoy the weekend,

Jonny

Disclaimer: Information in this article is from sources believed to be reliable; however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. Raymond James advisors are not tax advisors and we recommend that clients seek independent advice from a professional advisor on tax-related matters. The views are those of the author, Jonathan Van Dam, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member Canadian Investor Protection Fund.