A Touch of Frost #2 – Saving for Your First Home, Historical Performance of Drawdowns, + Medalta Potteries Hotel

Cash Flow Planning for Your First Home

Purchasing your first home is a major financial milestone, and for many, it can feel overwhelming. With today’s elevated home prices and interest rates, planning ahead is more important than ever. Fortunately, working with a Certified Cash Flow Specialist (CCS) can help you build a structured plan to support your homeownership goals.

As an independent brokerage, we can also assist in setting up a First Home Savings Account (FHSA) and, potentially, a Registered Retirement Savings Plan (RRSP) strategy to complement your cash flow plan. Here are some key considerations for first-time home buyers:

- Start Saving and Build a Cash Flow Plan

A personalized cash flow plan helps you identify opportunities to save and manage your spending, making it easier to consistently set aside funds for your home. While most people focus on the down payment, it’s important to also budget for:

- Closing costs

- Legal fees

- Realtor commissions

- Home inspections

- Taxes and insurance

- Utilities and moving expenses

As a general rule, allocate at least 2.5% of the purchase price for these additional costs. For example, if you're purchasing a home for $499,900, a minimum 5% down payment would be $24,995. Adding 2.5% for other expenses ($12,497) brings your total estimated upfront cost to $37,492.

- Consider Opening an FHSA and RRSP

Once your savings goals are defined, the next step is choosing the right accounts to hold your funds:

- First Home Savings Account (FHSA): Available to Canadian residents aged 18 or older who are first-time home buyers. You can contribute up to $8,000 annually, with a lifetime limit of $40,000. Contributions are tax-deductible, and investment growth within the account is tax-free. Funds can be used tax-free for a qualifying home purchase.

- RRSP Home Buyers’ Plan (HBP): You may also be eligible to withdraw up to $60,000 from your RRSP under the HBP. This amount must be repaid over 15 years, with the first repayment due within five years of the withdrawal.

Combining both the FHSA and RRSP HBP can help maximize your tax advantages and increase the funds available for your home purchase. Be sure to consult a licensed advisor to determine what’s best for your situation.

- Don’t Skip the Home Inspection

We recently supported a client who was considering a home in a new neighbourhood. We advised them to include a home inspection condition in their offer. The inspection revealed significant structural issues that weren’t visible during the initial viewing. As a result, the client avoided a costly mistake and found a better-suited property.

A home inspection is a small investment that can save you thousands and provide peace of mind.

- Speak with a Licensed Insurance Advisor

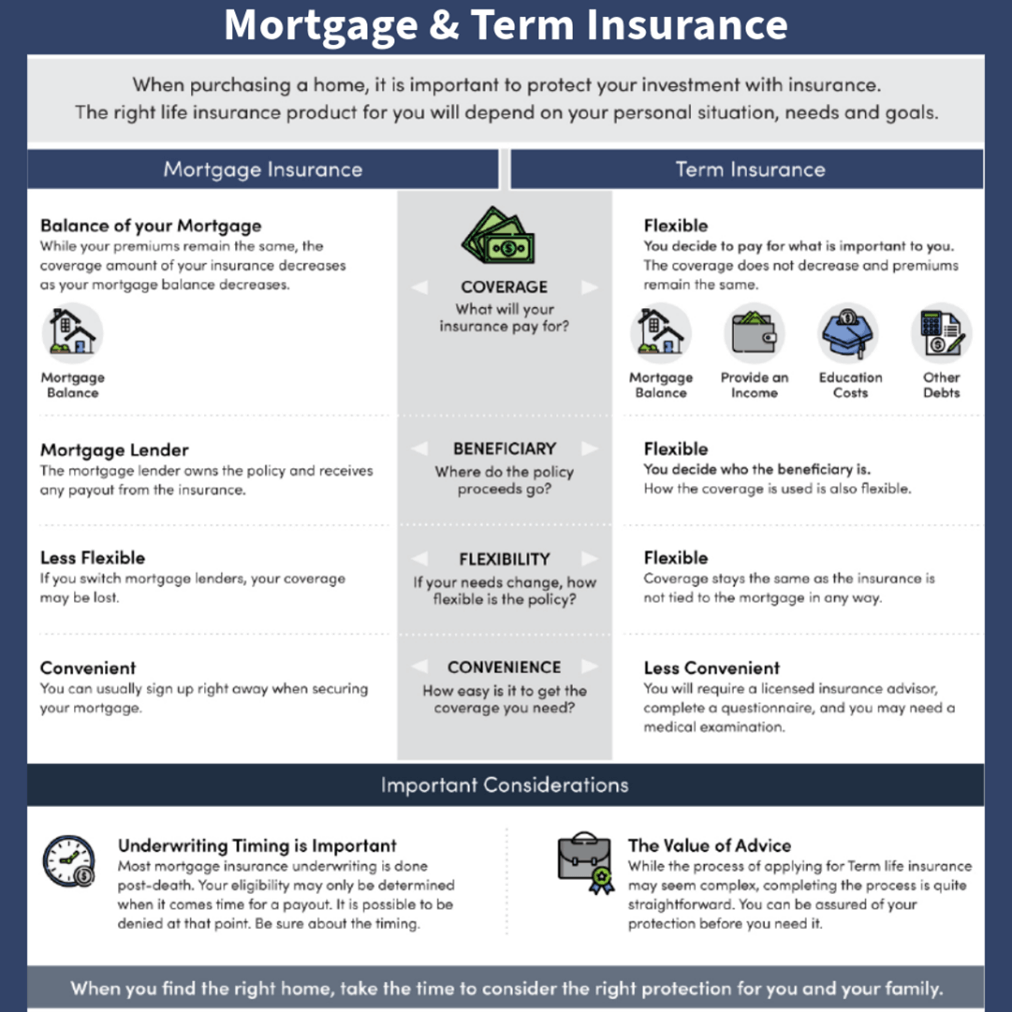

When you take out a mortgage, it’s essential to consider how your family would manage the debt if something were to happen to you. Mortgage protection insurance is one option, but it’s important to understand how it works.

Many traditional mortgage term insurance policies are designed to decrease in coverage as your mortgage balance declines. However, depending on your financial goals and family needs, a level term life insurance policy, which maintains a consistent benefit, may be more appropriate.

A licensed insurance advisor can help you compare options and determine the best fit for your situation. Be sure to review the terms, costs, and coverage limitations of any policy before making a decision.

- Work with a Trusted Real Estate Agent

Partnering with an experienced real estate agent—especially one who knows your target neighbourhood, can make a significant difference in your home buying journey. A knowledgeable agent can:

- Help you navigate the local market

- Provide insights on pricing and property history

- Assist with negotiations and paperwork

- Connect you with other professionals (inspectors, lawyers, etc.)

Choosing the right agent can make the process smoother and more efficient.

What We’re Reading and Watching

Here are a few recent reads and resources we’ve found insightful:

- Ben Carlson – A Wealth of Common Sense - Market Puke and Rally

Market Puke and Rally: Since 1950, there have been 41 double-digit market drawdowns (excluding this year). Interestingly, in 61% of those years, the market still ended in positive territory. - Suzanne Yar Khan – 5 tips for first-time homebuyers

Originally published in 2022, this article remains relevant and was a source of inspiration for this blog and our video content. - Larry Adams, CIO of Raymond James Financial (USA)

Taking the Pulse of Trade, Taxes, Earnings, and the Economy A comprehensive look at the U.S. economy, including business inventories, transportation trends, government policy, and Q1 earnings insights.

Historical Highlight: Medalta Potteries

A fascinating piece of Canadian history—Medalta Potteries, a ceramic manufacturer in Medicine Hat, operated from 1915 to 1954. At its peak, it produced 75% of Canada’s stoneware and was the first to ship goods beyond Manitoba.

During the Great Depression, Medalta’s kilns—still warm from daily use—became an unofficial shelter. Up to 40 men a night would sleep inside the kilns, finding warmth and rest before continuing their journey. The only rule? Be gone by morning so production could resume.

Quote of the Week

“We all have different things we want that we can’t have right now. That’s a situation scientists refer to as ‘life.’ It’s natural to get frustrated about that. There’s anger associated with yearning for a desire that is out of reach. But here’s a soundtrack to remember for those moments:

“Frustration or Fuel, My Choice.”

— Jon Acuff

Disclaimer: Information in this article is from sources believed to be reliable; however, we cannot represent that it is accurate or complete. It is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell securities. The views are those of the author, Jonathan Van Dam, and not necessarily those of Raymond James Ltd. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. Raymond James Ltd. is a Member - Canadian Investor Protection Fund.