Conservative, pragmatic and proud of the way we do business

Retire Faster

Is your mutual fund making you work 5 to 10 years longer than you need to?

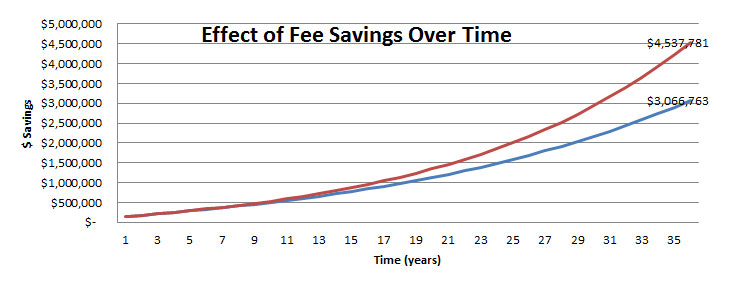

Your mutual fund company could be making you retire 5 to 10 years later than you should. Mutual fund companies’ high fee rates eat into your portfolio growth, lengthening how long you must work before you can retire. By introducing portfolio based fixed fees and flexible investment choices like Exchange Traded Funds, you could be looking at an earlier retirement age.

The Right Plan For You

The strategy that’s right for you depends on where you are now, and where you need to head. Tom Popielarczyk will help you build a plan, execute moves, and make changes at each stage of your game when needed.

Greater Flexibility, Lesser Fees

Finding greater growth requires access to new vehicles like Exchange Traded Funds, individual stocks, Mortgage Investment Corporations and Real Estate Investment Trusts. You get access to all of this with fixed fee rates that can be less than half of what you currently pay.

Zero Conflict

Our fixed fees are based on your portfolio size and growth. Our team is compensated by the size and growth of your overall portfolio, not by which funds are in it. Our interests are aligned with yours – to grow your portfolio over time.

This is a mathematical projection only. The client’s performance may differ from that of the model performance described due to timing of cash flows, etc., and the performance calculation of the model may be different than that of the index used as a reference point for comparison. Assumes a 7.5% long term average return before fees, and contributing $2k/monthly for 35 years.

Call Tom Popielarczyk to see how much faster you could retire.

Related Resources

The most widely recognized financial planning designation in Canada and worldwide, the Certified Financial Planner® designation provides assurance to Canadians that the design of their financial future rests with a professional who will put their clients’ interests ahead of their own. CFP certification is considered the standard for the financial planning profession worldwide. CFP professionals have demonstrated the knowledge, skills, experience and ethics to examine their clients’ entire financial picture, at the highest level of complexity required of the profession, and work with their clients to build a financial plan so that they can Live Life Confidently™.

The Chartered Investment Manager® (CIM®) Designation builds the skills and experience we need to serve a more sophisticated financial client or institution. Financial professionals who hold the CIM® designation are eligible for registration as a Portfolio Manager in Canada. They have expertise in providing money management services to high-net-worth and institutional clients, and they understand the application of portfolio management in the context of Canadian markets and regulatory requirements.

What do these designations mean for you? They mean that when you work with an investment consultant who has taken the time to complete these designations, you’re working with someone who is well-versed in modern concepts of investment advice, is educated enough to understand how your individual investments are being managed and how they work together – no matter how complex it may be. These skills, along with a commitment to advanced education, enable them to provide you with the kind of service that you not only want, but deserve.