The financial landscape for Canadians varies so much that many people need help navigating their way through. I meet people daily who are having trouble making decisions about where to turn next. When one issue seems to be figured out, the rules change and you can find yourself trapped in what feels like a house of mirrors. To top this off, many Canadians utilize the services of more than one financial advisor, which can lead to: potential overlap in investments; paying higher fees; additional administration charges; potentially increase the risk you take, as your advisors may both buy TOO much of a particular asset class; and waste valuable time (the one resource we all lack enough of), as you will have to evaluate extra investment options, have extra meetings and phone calls, etc., not to mention the difficulties faced when presented with conflicting ideas.

According to a study produced by the Bank of Montreal July, 2016, titled The Personal Balance Sheet, Canadians have identified five areas of priority with regards to saving, investing, borrowing, and spending. These priorities are in descending order of importance:

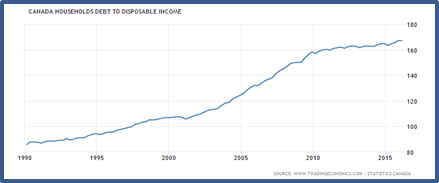

Each of these areas of priority are extremely important, at all ages, and in all stages of our financial lives, but looking at the data shows a serious problem with our behaviour, when it comes to fulfilling these priorities. Let me show you what I mean. The first priority listed above by 30% of all respondents, was to reduce or eliminate debt, yet according to Statistics Canada report 06-14-2016 total Household Credit Market Debt is steady at 165.3%. In real money, that means that for every dollar of disposable household income  Canadians owed $1.65. This marks Canada as one of the highest debt holding countries in the world. The chart on the left is from the office of the parliamentary budget office, published in The National Post. It shows that debt in Canada has risen 66% since 2000. The problem is that we as consumers receive no training on HOW to manage debt, only that we should manage it. As interest rates have fallen steadily over the same time, carrying debt has become more affordable for Canadians, and with the implementation of internet banking, unconscious spending using cards (debit and credit), automated payments, makes it nearly impossible for people to keep track. I’ll show you a solution in a moment, but for now let’s move to the next priority.

Canadians owed $1.65. This marks Canada as one of the highest debt holding countries in the world. The chart on the left is from the office of the parliamentary budget office, published in The National Post. It shows that debt in Canada has risen 66% since 2000. The problem is that we as consumers receive no training on HOW to manage debt, only that we should manage it. As interest rates have fallen steadily over the same time, carrying debt has become more affordable for Canadians, and with the implementation of internet banking, unconscious spending using cards (debit and credit), automated payments, makes it nearly impossible for people to keep track. I’ll show you a solution in a moment, but for now let’s move to the next priority.

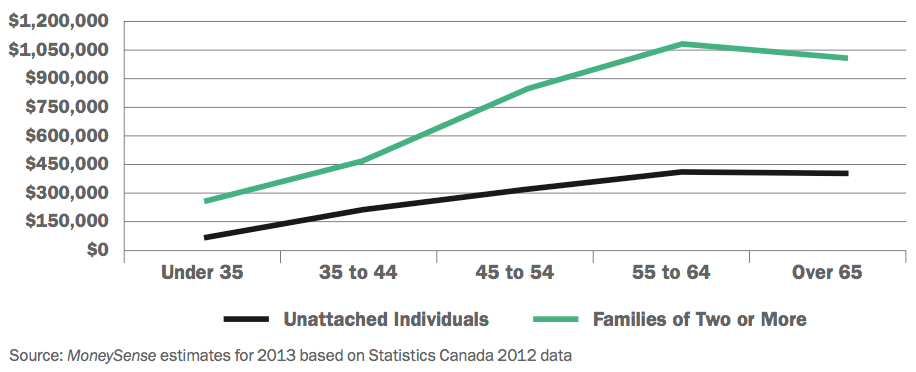

Investing effectively and tax efficiently is the second most important financial priority for Canadians according to the BMO report, with an overall rating of 24% by all surveyed. Not surprisingly, people in the 55+ age group scored this item higher (29%) than people in the lower age brackets (24% for ages 35-54 and 20% for those 18-34), which makes sense given that the vast majority of wealth lies with  older Canadians in individual and family units.

older Canadians in individual and family units.

This chart looks at the level of wealth in Canada both in age and family type. Mark Brown and David Hodges wrote in the January 2015 issue of Money Sense Magazine: “Families can build wealth faster than individuals because they’re able to pool their resources, which enables them to pay down debts faster and make larger purchases.” Whether you are an individual or part of a family unit, the chart shows that people over age 55 are the largest holders of wealth and therefore would have the potential to have the highest investment incomes, meaning they potentially would have to pay higher taxes, so tax efficiency should be at the top of their list of priorities. A March 2015 exclusive article on TFSAs in The Financial Post shows only 38% of Canadians (10.7million people) had a TFSA and that only 7% (1.9 Million) of eligible Canadians over 18 had maxed out their contribution room. That same article shows a great quote from a source in the conservative party “TFSAs are primarily used by low and middle income Canadians, and by seniors. Of those who maxed out their TFSA, sixty per cent (60%) earn less than $60,000….” Once again this shows disparity between the actions of Canadians and their stated desires. The majority of the wealth lies with people over age 55, yet they aren’t taking advantage of this great tax efficient vehicle. This constant contradiction of behaviour vs. desires says to me that our clients truly need the advice we provide and can benefit greatly from it. In addition it also shows that we owe our clients the service of planning (retirement, cash flow, estate, major purchases, etc.) that completes the circle for them, by showing them HOW to accomplish these priorities, rather than just telling them they need to do it.

The third priority listed in the BMO survey is to save more. Noble idea, and certainly should be a focus for nearly every client I meet with, but I was surprised and perplexed at the number of 35-54 year olds who treated saving more as a priority -- only 24%. I wasn’t shocked to learn that only 15% of near retirees considered saving more was a priority, but the group is vast and there isn’t enough data to show the true reflection of need or desire of respondents over age 65 who are into the decumulation phase of life in which they are starting to spend their hard earned retirement rather than putting money towards it.

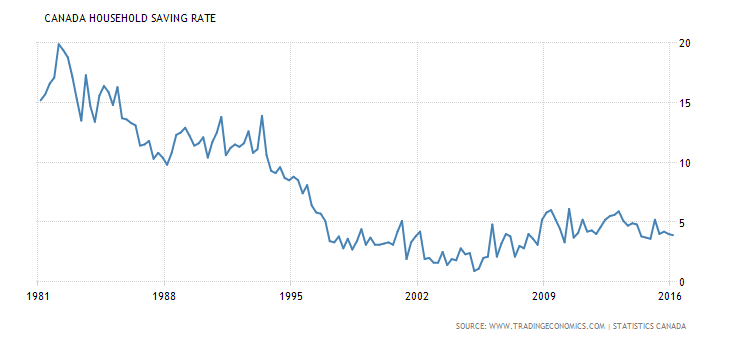

What does the 55-64 age group look like in terms of saving more? These are the last years people have to fund their “dream retirement” and likely their highest earning years. There may even be the lucky few who had the good fortune to work at a job which still offered a tremendous Defined Benefit pension plan. Those fortunate folks will have put in the 25-35 years of service required to command a full pension and as such probably don’t feel the need to accumulate a great deal more than they saved in the early stages of their lives. All that being said; I use a website called www.tradingeconomics.com which has some fabulous information on nearly everything financial, and they have some terrific insights which they correlate directly from Stats-Canada. They have mapped out personal savings rates of Canadians since 1981.

The savings rate has averaged 7.52% since 1981, including the good old days when the highest rate of savings was 19.90% but by 2005 that same savings rate had dropped to less than 1% of income.  The rate of savings started climbing in 2006, and then started to decline in 2010, but is nowhere near what it should be. The average in the last 10 years is just over 4% and currently sits at 3.9%. The inset chart shows levels of personal debt since 1990. It climbs at an enormous rate.

The rate of savings started climbing in 2006, and then started to decline in 2010, but is nowhere near what it should be. The average in the last 10 years is just over 4% and currently sits at 3.9%. The inset chart shows levels of personal debt since 1990. It climbs at an enormous rate.

This again shows the disconnect in behaviour of Canadians from their priorities. However it does show that since levels of personal debt have risen dramatically from the early 1980’s as discussed above, the money left over from our paycheck after paying the credit card, the mortgage, the car payments, etc., there is less money to save. In my last writing I showed how it takes $410,625 to eat during retirement. This wealth test from http://www.moneysense.ca also shows incomes by province (we will look at numbers from Alberta), and breaks the categories into five groups of 20% from the poorest to richest. For this example, I am using the middle income average amount of $81663. We take 3.9% (average savings rate) of that amount which gives us $3184.86, which incidentally, is far less than the $5500 TFSA maximum above, showing why these accounts aren’t filled up. But if we take the $410,625 needed to eat during retirement and divide it by the average $3184.86 annual savings (even when tax free), it tells us it would take nearly 130 years to save up for the food we are going to eat in retirement! It tells me and hopefully you that yes indeed savings need to increase dramatically, in order to achieve our needs, but where will the extra money come from? Is there some magical machine in the garage that is going to provide it? Nope. What about a money tree in the back yard. Nope, that’s not realistic either. The reality is that unless you are one of the fortunate few who will still receive a pension from your employer, aside from the Canada Pension Plan (CPP) and Old Age Security (OAS), saving for retirement will be a SOLO effort. This brings us to the fourth item on our list of priorities -- budgeting!

Budgeting by definition: is an estimate, often itemized, of expected income and expenses for a given period of time. Sounds easy enough, but it doesn’t fit the way we live. The problem is that budgeting is static rather than fluid which is how our lives operate. It works with hard data and assumes that life doesn’t happen. Let’s look at a hypothetical situation. Bob and Molly Jones have an average family with 2 kids and a dog, and average house in an average neighborhood. You get the picture. This month, they have $5830 deposited to the bank, which is the net amount they receive for their $81663 income in 2016. They budget for all the bills (mortgage, property taxes, utilities, car payment, insurance, gas, house phone, cell phone, maintenance, child care, alarm, etc.) at $4000, budget for some groceries at $800, piano lessons and hockey dues for $200 each (x 2 kids), clothing $300, which leaves roughly $500 for spending money. Budget complete. Sounds like a reasonable idea right? In theory yes. But in reality extremely difficult.

The problem is we humans aren’t wired that way. We are not robotic and can’t project our path in front of us. WE don’t run on predetermined rails, or have electronics that determine when and where we move. We are free to make choices and have the ability to adapt. Sure, many of us have similar patterns that we follow daily, and as creatures of habit, which most people tend to be, we often have routines that we follow for short timeframes. For example, many people have the same routine when getting ready in the morning, or driving the same route to work as we feel we know the traffic, or take breaks during the day at the same coffee time for their favourite lattes (yes, that’s you Stephanie). We mostly follow the same path through the grocery store each week as we eat the same food most often, because we enjoy it so we know (or think we do) the best route through the store.

Here is the main flaw in budgeting: We cannot account for what the world puts in front of us. We don’t know when the car will break down, or that the kids will have a field trip at school tomorrow and they forgot to bring home the permission slip until 3 pm today.

Oh, and that the cost is $25 for the bus and lunch. Nobody tells us when we will have a rough day at work, with that new project that needs to be completed ASAP so we had to work late and got take out rather than went home for dinner. Nor will your budget tell you about personal tragedies that are coming (think of the Aspirin commercial, with the guy who gets a note on his car saying he will have a heart attack tonight.) The BMO report suggests “families strongly consider” having home, disability (for income replacement) and life insurance, for when these problems occur, but they show nothing that finds room in the budget for paying the insurance premiums. In many articles I read on financial advice, the consensus is to buy more products, rather than advice on HOW to pay for them.

Life doesn’t take into account that you have a budget. I didn’t include any of the items above in our example, but we all have these types of experiences. Sure we could add them to our budget, but when they don’t happen, what do we do? We spend the money that we had put aside in the little jars on the counter, or the envelopes system your mother taught you when you were a kid. We all have the best intentions of replacing it but most often that doesn’t occur. Worse still, what happens when you have more surprises than budgeted? Or the car repair was $1000 instead of $500. You don’t have $1000! You don’t have the original $500 that we spent because we didn’t need it last month. So out comes the trusty credit card, which we fully intend to pay off, by adding it to our budget; next month. The problem now becomes how you plan to pay off the card. Out of the $500 spending money you had, you will take $100/month to pay that off. Still have $400 left. Perfect. Problem solved right? Wrong.

Inevitably, once you have set up the new budget to handle last month’s problem, the next one creeps up and BAM, Fridge quit. Or the A/C craters in the middle of July. Or the furnace quits on Christmas Eve at 8pm. (don’t laugh, this happened to me twice.) Rob, the guy who came to fix the furnace both times was incredibly appeasing, considering his family was missing out on him being home for the special day, but the bill for the emergency call out and repair was enough to ensure he had a lot less worries in January when his credit card bill came! Interestingly enough, we had a rainstorm the other night, and my basement had 1 inch of water in it. This has never happened to us before but it was a particularly strong rainstorm that happened to come from a weird direction, filled up the window wells and the rest, as they say is history. I have insurance for this type of thing as we all should, but the deductible is going to be $1000, but I digress, you get the picture. The problem doesn’t matter. Just know it is another new $1000 problem. Could be more, could be less. We could simply say we will make do and just have less spending money, but you and I both know that we don’t live that way. According to the BMO survey, 39% of respondents have been impacted financially by a major unexpected incident. I’ll wrap this up by saying budgets are best used in a project like home renovation, or fixing up and restoring grandad’s old car, where you can get quotes, assess timeframes, and even add contingency for the extra chrome you want to put on, but they don’t work for day to day life.

The final priority listed in the report, was spending on personal needs or goals. On average only 4% of those surveyed considered it a priority. That figure was 6% for the 55+ crowd, and only 3% for the 35-54 age bunch. In fact, this is where the idea for this writing came from. When I read these stats, (for the third time), the dramatic differences between our behaviour and our priorities hit me. Certainly of those surveyed this is the case.

Spending is in my opinion the most important factor of the five priorities, as we have little control over how much we make, or how much we pay for the past (debt). How much tax we pay is also dependent on our income and aside from a small list of options for efficiency, we have little control in this area. We just discussed how saving will be needed in the long term; however, I can’t tell you how much you need to save until I fully and clearly understand how much you spend. The reasons behind this thought are simple. When I started in this business, I was taught that a retirement plan should include ~70% of your pre-retirement income to maintain your lifestyle in retirement. What I have found in practice rather, is that your income needs will probably remain constant at the beginning of your retirement or may even go up a little in the beginning stages of your new found freedom. This work is certainly not to tell you HOW to spend your money, or to tell you that you’re doing it wrong as “Money problems will never be solved by Math and Shame!” says Stephanie Holmes-Winton, CEO of The Money Finder. To be clear, my job as a certified Cashflow Specialist (CCS), is to show you how much you CAN spend on the things you want to accomplish, and find the dollars that are being lost to inefficient interest and unconscious spending. I described above how budgeting can’t and won’t work long term for many people.

Essentially, most of your bills will be the same and you sure don’t get a reprieve from payment because you are fortunate enough to stop working full time and move into your next phase of life and every day is Saturday! Do your property taxes drop because you retire? No. How about the price of a bottle of Coca Cola? No. Will McDonald’s sell you a big mac cheaper as you age? After all you might not be able to eat it all at one sitting. Not a chance! You might save some money on car insurance, or get 10% off at certain stores on certain days of the month, but for the most part, prices start going up in retirement not down. World renowned author, speaker and coach in the insurance industry Anthony Morris, whose accolades are too many to mention, has a wonderful analogy which is: “Doctors, Pills, Hospitals and Caribbean cruises, the basket of goodies we shop for in our golden years of retirement, go up in price by a lot more each year than Bread, Butter, Property, and Cars, which is the basket we shop for in our younger years!”.

The fact that many people are holding record high levels of debt, causing lower cash flow or disposable income; makes them want to stretch their money further, creating the need for the budget (which won’t work, for the above reasons). When adding in the $1000 problems also discussed above, people now have less money than they thought, which means we have to give up something, and, as saving for the future is the last thing on the list, it’s the easiest thing to cut from a budget. The BMO report explains this, especially for millennials, as YOLO (you only live once).

As saving and investing have longer time horizons that can’t be seen or relied upon in the eyes of this generation, combined with the fact that budgeting cuts out the things we want today in favour of saving for later; it’s not going to happen.

This disparity between behaviour and priorities tells me that people are dissatisfied with the current way they do things but have a hard time making changes. We are reluctant to make these changes even for our benefit, as change is hard for one thing, and there is much work involved, but scary or uncomfortable on the other hand. An interesting dilemma. Our lizard brains are always telling us to avoid conflict, take the easy path, and stick with what’s known. “I could make life better, but at what cost?” “What will I have to give up for this?”, “what if it doesn’t work?” Another way to look at this is: “What more do I want from life that I can’t get doing it this old way?” “Do I still have a need for this thing I used to want that just sits here?”, “What if it does work?” One reason for not changing is that people have no idea HOW to improve their situation or they believe that the change won’t work. My answer to that is Denial is not a river in Egypt, but a financial terminal disease. There is no training for this level of complex cash flow requirements. Not in high school, university, or many of the professional designations offered in Canada today. Many people get an introduction to money and then learn the hard way when they turn 18 when they are given their first credit card and, as my dad used to tell me ”they get thrown in the deep end of the pool and someone shoots out the water wings”. Some figure it out quickly, many don’t and never will.

Now that you have found yourself in this position, of your priorities not matching your behavior, what can you do about it? The first step is to get a cash flow plan. Cash Flow Plans are custom built by Certified Cash Flow Specialists, or CCS designated professionals in Canada. This is the only designation offered in the country that is solely focused on you, your goals and dreams and gives written direction on HOW to get more life from the money you already have. A Cash Flow Plan is NOT a budget. (Budgets don’t work long term). It is a customized work that takes into account your actual income, matches it with your money mindset, (your priorities) and then works out the exact steps you need to take to achieve your dreams. (Your behaviour). I mentioned Stephanie Holmes-Winton before and I have a great deal of respect for her. She is the Founder and CEO of the Money Finder, the organization responsible for all CSS professionals. She has written two incredible books, Diffusing the Debt Bomb, and $pent, Your Money Mindset is the Key to Your Financial Freedom. This second book is incredible and should be a must read for every family in Canada.

She allowed me to share with you an excerpt from chapter 4 of $pent, about the types of people who don’t need to worry about spending.

In order to qualify as one of these people, you must meet all of the following criteria:

OR

If you are under 60, you are independently wealthy and have assets that would be almost impossible to deplete in your lifetime.

If ANY of the seven are missing, the opportunity for the unexpected to deplete your security is always present. I don’t say this to scare you, but very few people can be prepared for all eventualities. What I do think is that unless your life is 100 percent guaranteed, whether you make $30000, $70000, or $1000000 per year, your life will be well served if you pay attention to your spending.

I think it is safe to assume there are many people can’t answer yes to all of the above criteria, including me. That is why this work is so very important. The key to your financial freedom is to match your behaviour to your priorities. This work is too important to put off and I encourage you to contact us if you are dissatisfied with your current plan, or lack thereof. Our team is ready to help. Feel free to visit our website at www.frostgroup.ca, for more information on cash flow planning; we are here to help.

Dan Frost

Financial Advisor

The views expressed are those of the author, Dan Frost, and not necessarily those of Raymond James Ltd. It is provided as a general source of information only and should not be considered to be personal investment advice or a solicitation to buy or sell securities. Investors considering any investment should consult with their Investment Advisor to ensure that it is suitable for the investor’s circumstances and risk tolerance before making any investment decision. The information contained in this article was obtained from sources believed to be reliable, however, we cannot represent that it is accurate or complete. Securities-related products and services are offered through Raymond James Ltd., Member - Canadian Investor Protection Fund. Insurance products and services are offered through Raymond James Financial Planning Ltd., which is not a Member – Canadian Investor Protection Fund. www.raymondjames.ca