2Q25 — An Incredible Recovery

It's difficult to imagine a greater range of emotions than what investors experienced over the prior three-month period. The beginning and end of the second quarter couldn't have been more different. In early April, the S&P 500 was down over 20% from its February all-time high amid an escalating trade war that threatened to upend the global economy.

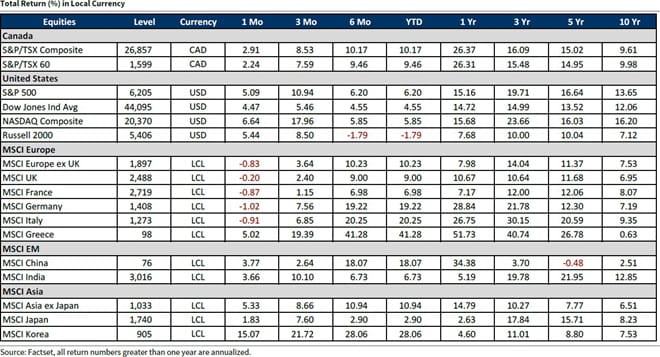

Equities

Stocks enjoyed a stellar second quarter despite their rocky start. The S&P 500 gained 10.57% during the April-June period, while the tech-heavy NASDAQ 100 rallied an even more robust 17.64%. In Canada, the S&P/TSX Composite Index rose 8.2% in Q2, driven by the outperformance of the Technology, Energy, and Materials sectors.

Key market returns for Q2 2025:

- S&P 500 (US): 57%

- NASDAQ 100 (US): 64%

- S&P/TSX Composite Index (Canada):2%

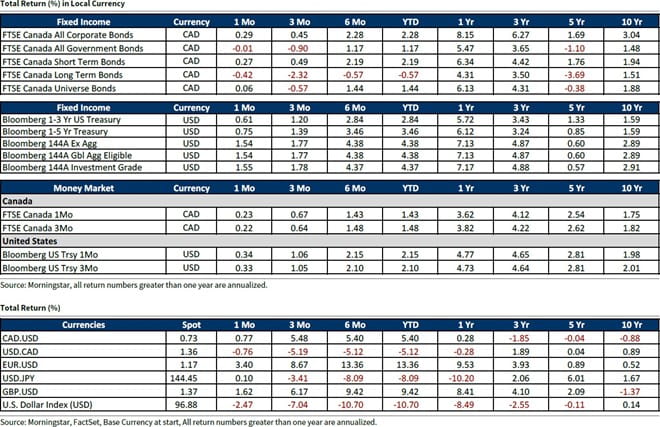

Bonds

The bond market was more mixed during the second quarter. The benchmark 10-Year US Treasury yield finished June at 4.23%, while the 10-Year Government of Canada bond yield ended June at 3.45%. The US Core Bond Index gained 1.17% for the quarter.

Commodities

Commodities were pulled by opposing forces during the second quarter. Oil prices fell 8.9% from the start of April, while gold added another 5% to its impressive move over the past year.

Conclusion

The stock market made it clear that it was looking past risks and toward a brighter future. With ongoing trade negotiations, monetary policy decisions, and geopolitical tensions, global markets will continue to navigate potential catalysts. However, the breakouts to new all-time highs in the S&P 500 and NASDAQ 100 suggest the market believes the worst is already behind us.

Complete disclosures for companies covered by Raymond James can be viewed at: www.raymondjames.ca/researchdisclosures

Raymond James Ltd. (RJL) prepared this newsletter. Information is from sources believed to be reliable but accuracy cannot be guaranteed. It is for informational purposes only. It is not meant to provide legal or tax advice; as each situation is different, individuals should seek advice based on their circumstances. This document is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The securities discussed in this document may not be eligible for sale in some jurisdictions. This research is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. RJL, its officers, directors, agents, employees and families may from time to time hold long or short positions in the securities mentioned herein and may engage in transactions contrary to the conclusions in this newsletter. RJL may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this newsletter. Securities offered through Raymond James Ltd., Member-Canadian Investor Protection Fund. Financial planning and insurance offered through Raymond James Financial Planning Ltd., not a Member-Canadian Investor Protection Fund. Commissions, trailing commissions, management fees and expenses all may be associated with mutual funds. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.