3Q 2025 — The Calm After the Calm

After a turbulent first four months of 2025, North American stock markets staged an incredible recovery to close out the first half of the year. A calm settled over both asset prices and investors as the heightened volatility waned. This tranquility not only continued through the end of the third quarter but became even more pronounced. Investor sentiment, which had sunk so low in early April, brightened considerably as the markets overcame every potential stumbling block standing in their way. There was no shortage of headline events that could have possibly upset the balance once again – the passing of a controversial tax bill in the US, escalating geopolitical tension, sticky inflation, discord between the Trump administration and the Federal Reserve, etc. – yet through it all the markets kept chugging along.

Canadian Economic Outlook

Consumer spending in Canada remains resilient, supported by household savings and wealth effects from strong equity market performance. However, rising unemployment could dampen future consumption. The housing market continues to show strength in terms of sales, although prices remain down year-to-date. Rental markets are soft, impacted by elevated inventories and slowing immigration. Inflation remains contained, with headline CPI rising to 1.9% in August— still below the Bank of Canada’s 2% target — and core inflation measures holding steady. Looking ahead, the federal budget is scheduled for November 4 and is expected to include increased infrastructure and industrial investment. The deficit is projected to widen to $68.5 billion for the 2025–26 fiscal year.

Tariffs

Tariffs remain a significant concern for investors. The effective U.S. tariff rate rose to approximately 17.9%, although Canada has been relatively shielded thanks to exemptions under the USMCA. Nonetheless, sectors such as automotive, steel, and aluminum continue to face pressure. Legal challenges to the use of the International Emergency Economic Powers Act(IEEPA) for broad tariff implementation are ongoing, with a potential Supreme Court review expected in 2026.

Equities

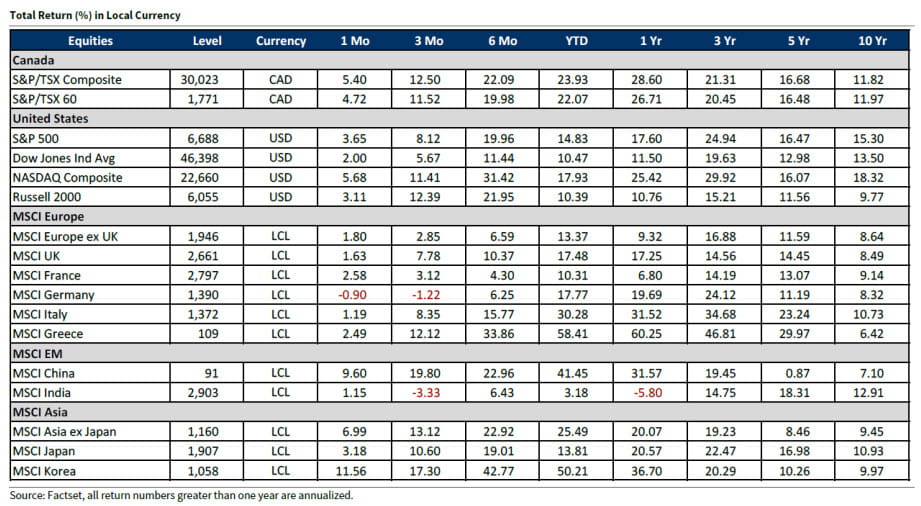

The major story in the Canadian and the United States stock markets was their outright refusal too ffer any meaningful pullback for investors hoping for a more attractive buying opportunity. Canadian equities performed strongly, with the TSX Composite Index gaining 5.1% in September and 12.5% over the third quarter. The Materials sector led the way with a 37.8% return, followed by Information Technology and Energy. Gold miners were particularly notable, benefiting from rising commodity prices and robust cash flow. The S&P 500's worst drawdown during the quarter lasted all of two sessions and only knocked the large-cap index down 3.46%. The robust persistence echoed the ~15-month period from 2016-2018 when the index staged a similar rally while never dipping more than around 2-3%. The S&P 500 gained 7.79% overall during quarter three, including its best September since 2010. While some broader market measures, such as the percentage of NYSE stocks above the 50-day moving average, did top out earlier in the summer, there was sufficient residual strength to achieve new all-time highs across many of the major indices well into September. Even the small cap Russell 2000 struck an all-time high for the first time since November 2021, ending its second longest streak without a new high on record (source: Bespoke Investment Group). The gains were not limited to the United States, either; the FTSE All-World Ex USA Index maintained its own impressive run to hit a number of new all-time highs and extend its2025 performance to 23.26% (source: Google Finance). While the U.S. stock market does remain historically overvalued by some measures, it continues to entice new buyers, and regular rotations from sector to sector have helped to buoy the averages.

Bonds

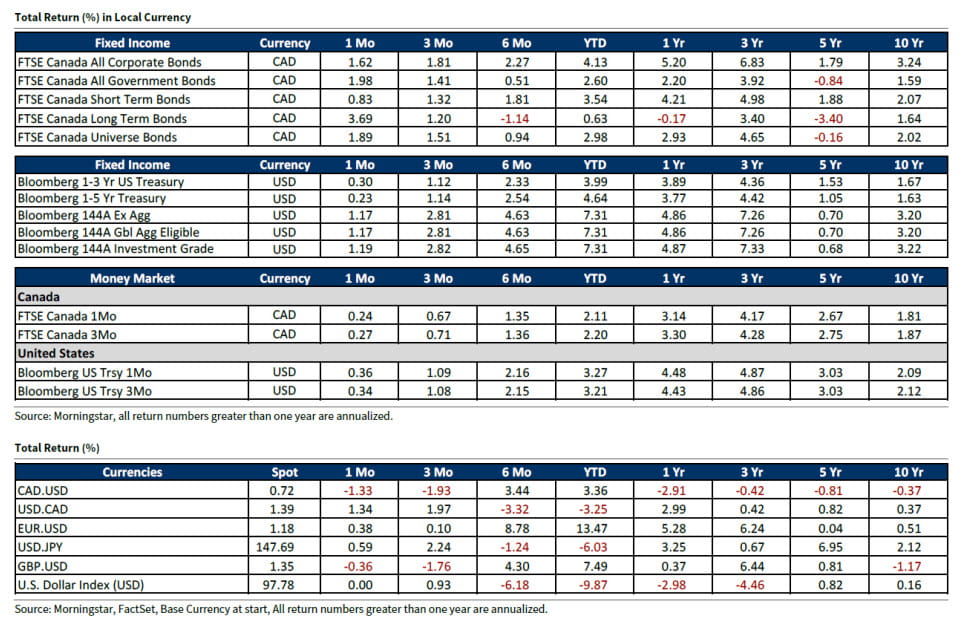

The bond market may not have enjoyed the same remarkable returns as stocks, but it, too, was relatively calm during the third quarter. According to Reuters, implied U.S. bond volatility, as measured by the ICE BofAML MOVE Index, dropped to its lowest point in over three years in September, an amazing development considering all the uncertainty surrounding the economy and interest rates. Intermediate-to-long-term rate expectations continue to be pulled in opposing directions by competing forces: a slowing economy and looser monetary policy is putting downward pressure on rates while sticky inflation is helping to keep them from falling too much. The result is that the 10-Year U.S. Treasury yield has been contained within a range of around 3.6% to 5.0% for more than two years. That range condensed even further during the third quarter, as the benchmark yield remained between 4-4.50%. In response to a slowing jobs market, the Federal Reserve cut the federal funds rate by 25 basis points (0.25%) at its September meeting. It was the first cut since December 2024, ending a contentious period when President Trump publicly criticized the central bank for delaying additional cuts and threatened to remove Fed Chair, Jerome Powell from the position. The Fed is currently projected to follow up September’s rate reduction with two additional cuts at its remaining two meetings of the year. Bond prices move inversely to interest rates, and the reduction in short-term rates helped to boost bond prices marginally during the quarter, sending the S&P U.S. Aggregate Bond Index up 2.0%.

Commodities

The Dow Jones Commodity Index, which aggregates several different commodities into one measure, returned 2.36% during the third quarter (source: S&P Global). However, that belies what was another exceptional period for precious metals. Gold and silver were quietly rangebound during much of July and August, but once they got going in September they did not stop, rallying 16.8% and 29.2%,respectively, over the three months. That impressive stretch extended gold's year-to-date return to47.0% and silver's to 61.5%. Other commodities did not experience such strong returns, though. West Texas Intermediate crude oil fell slightly from around $65 to $62 during the quarter, while natural gas similarly dropped 4.6%. A larger loss befell copper, which typically moves in response to global growth expectations. It collapsed from almost $6 to $4.30 in late July, before settling at $4.83 to end September. While there continues to be a debate surrounding the U.S. dollar's long-term position as the global reserve currency, especially in light of huge moves in gold and silver, the U.S. Dollar Index, which measures the dollar against a basket of foreign currencies, strengthened slightly during the quarter.

Conclusion

Overall, it was another rewarding quarter for investors willing to stay the course. The stock market and precious metals, in particular, provided outsized gains with little accompanying volatility. While risks remain on the horizon – a slowing global economy, persistent inflation, historically stretched equity valuations, and political/geopolitical tension – there is optimism that a more accommodative Federal Reserve and increased productivity benefits from artificial intelligence will help maintain the impressive resilience demonstrated over the past few months. There is also hope for increased fiscal stimulus in 2026 in advance of the midterm election, though the government shutdown to begin the fourth quarter presages potential gridlock in D.C. Nevertheless, there is minimal evidence to suggest the strong trends in place are reversing, which supports sticking with what is working as long as the status quo remains in place.

Complete disclosures for companies covered by Raymond James can be viewed at: www.raymondjames.ca/researchdisclosures

Raymond James Ltd. (RJL) prepared this newsletter. Information is from sources believed to be reliable but accuracy cannot be guaranteed. It is for informational purposes only. It is not meant to provide legal or tax advice; as each situation is different, individuals should seek advice based on their circumstances. This document is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The securities discussed in this document may not be eligible for sale in some jurisdictions. This research is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. RJL, its officers, directors, agents, employees and families may from time to time hold long or short positions in the securities mentioned herein and may engage in transactions contrary to the conclusions in this newsletter. RJL may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this newsletter. Securities offered through Raymond James Ltd., Member-Canadian Investor Protection Fund. Financial planning and insurance offered through Raymond James Financial Planning Ltd., not a Member-Canadian Investor Protection Fund. Commissions, trailing commissions, management fees and expenses all may be associated with mutual funds. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.