1Q25 — A Time of Transition

The first quarter of 2025 was a transitional period for the financial markets, the U.S. economy, and the world at large. President Trump's inauguration in January ushered in a new era, one widely expected to mark drastic changes even compared to his first term. Just like in 2016, there appeared to be a "Trump Bump" in the stock market and many "soft" indicators such as Consumer Confidence and Small Business Optimism immediately after the president's November election win. However, unlike eight years ago, the honeymoon period did not last long. The stock market experienced its worst quarter since 2022, while many economic data points rolled over amid the uncertain business and trade environment. By quarter's end, Consumer Confidence had fallen to its lowest level in four years and the Conference Board's Expectations Index —based on consumers’ short-term outlook for income, business, and labor market conditions—dropped to its lowest level in 12 years and well below the threshold that has historically signaled a recession ahead. The result was a rapid shift from a "risk on" to a "risk off" environment.

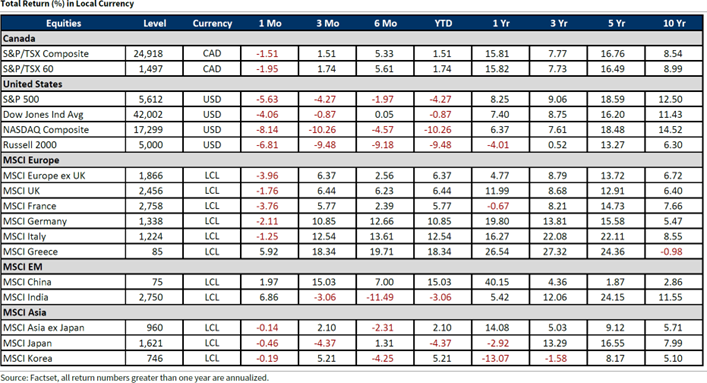

Equities

After back-to-back years of 20%+ gains in the S&P 500, the stock market was always going to have its work cut out for it to maintain that pace in 2025. While there was a lingering sense of optimism among stock investors as the new year began, that soon morphed into caution. Stocks were rangebound for the first month and a half, though the S&P 500 did manage to briefly touch a new all-time high in mid-February. Yet broader market measures largely topped during the November-December period and whipsawed around before more aggressive selling arrived in late February into March. As a result, the S&P 500 swiftly dropped more than 10% from its February high. The percentage of bullish investors in the weekly American Association of Individual Investors sentiment survey plummeted to only 19% during the pullback, its lowest reading since the second half of 2022. The selling was most severe in the mega cap-heavy Technology, Consumer Discretionary, and Communication Services sectors that had previously helped to keep pushing the market higher. Elsewhere, there was clear rotation taking place underneath the market's surface. 7 of 11 sectors actually finished the quarter in the green, with Energy, Health Care, and Utilities leading the way (source: Morningstar). Ultimately, it was not a good quarter for stocks, but the weakness certainly hit some areas much harder than others.

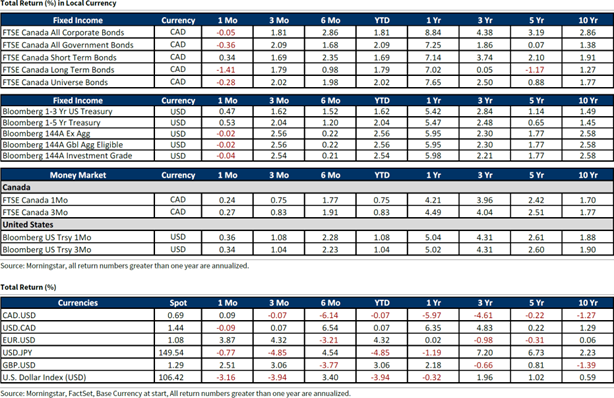

Bonds

Unlike in 2022 when both stocks and bonds suffered together, the bond market fortunately enjoyed a boost in the first quarter as interest rates declined. The increased uncertainty and softening in the economic data helped to put downward pressure on longer- term rates, in particular. The benchmark 10-Year U.S. Treasury yield dropped from 4.57% at the start of the year to a low of 4.10% in early March. This helped to lift bond prices, which move inversely to rates. The Morningstar Core U.S. Bond Index rallied 2.78% during the quarter to offset some of the losses in the major stock indices. Surprisingly, however, the unpredictable trade and business environments did not materially alter shorter-term interest rates. These tend to be more impacted by the Federal Reserve's policy rate, and additional rate cuts are not currently expected until at least the June Fed meeting.

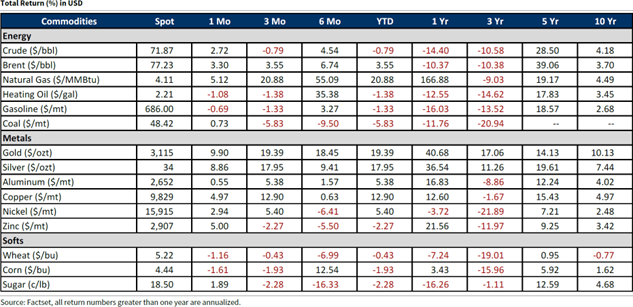

Commodities

Commodities also enjoyed a favorable first quarter, as inflation remained "sticky" and fears escalated that the newly implemented tariffs could keep prices higher for longer. Gold was a big winner during the first three months of the year, continuing its rally from late 2022. Gold prices rose 19% and breached the $3000 level for the first time in history. Copper shined, as well, rising about $1 (25%). These metals helped to carry commodity indices, even as crude oil and agricultural commodities, as a group, were essentially flat. Natural Gas prices were up, too, but not to the same degree as gold or copper.

Conclusion

It was a challenging quarter, overall, but one that helped illustrate the benefits of diversification. The stock market slumped, yet gains in the bond and commodities markets helped to offset that to some degree. Diversification will likely remain important given the ongoing uncertainty in the financial markets and in the broader economy. The escalation of the trade war could have some large ramifications as consumers and businesses adapt to the new environment. The economy is showing signs of slowing and that is before the real impacts of the tariffs are felt. As always, it will be crucial to have an investment plan that fits one's risk tolerances and objectives if volatility continues to be heightened.

Complete disclosures for companies covered by Raymond James can be viewed at: www.raymondjames.ca/researchdisclosures

Raymond James Ltd. (RJL) prepared this newsletter. Information is from sources believed to be reliable but accuracy cannot be guaranteed. It is for informational purposes only. It is not meant to provide legal or tax advice; as each situation is different, individuals should seek advice based on their circumstances. This document is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The securities discussed in this document may not be eligible for sale in some jurisdictions. This research is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. RJL, its officers, directors, agents, employees and families may from time to time hold long or short positions in the securities mentioned herein and may engage in transactions contrary to the conclusions in this newsletter. RJL may perform investment banking or other services for, or solicit investment banking business from, any company mentioned in this newsletter. Securities offered through Raymond James Ltd., Member-Canadian Investor Protection Fund. Financial planning and insurance offered through Raymond James Financial Planning Ltd., not a Member-Canadian Investor Protection Fund. Commissions, trailing commissions, management fees and expenses all may be associated with mutual funds. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.