Vista Tips May 2025

At Vista Financial Group, we recognize the growing interest in alternative investments as part of a diversified portfolio strategy. Inspired by the approaches of institutional investors such as the Canada Pension Plan (CPP) and Yale University, we incorporate select alternative asset classes where appropriate. While these investments have traditionally involved drawbacks—such as complex documentation, high minimums, and limited liquidity—newer strategies are emerging that aim to reduce these barriers.

One such strategy we have been employing is the Dynamic Alternative Yield Fund. This fund seeks to provide broader access to alternative investments by offering a more flexible structure. It is designed to evolve alongside the expanding landscape of alternative assets; however, it is important to note that alternative investments carry unique risks. While the fund is structured to offer improved liquidity compared to traditional alternatives, alternative investments may still involve risks such as valuation uncertainty, limited transparency, and sensitivity to market conditions.

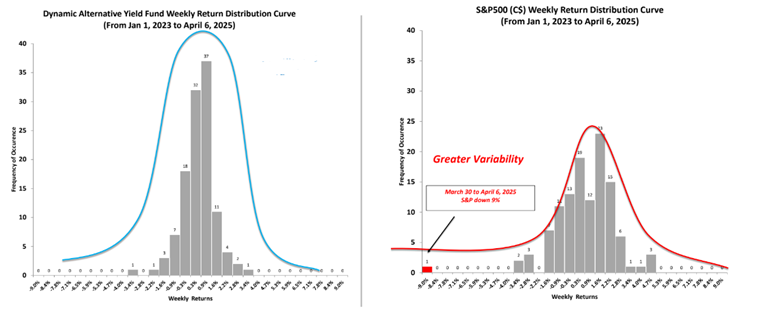

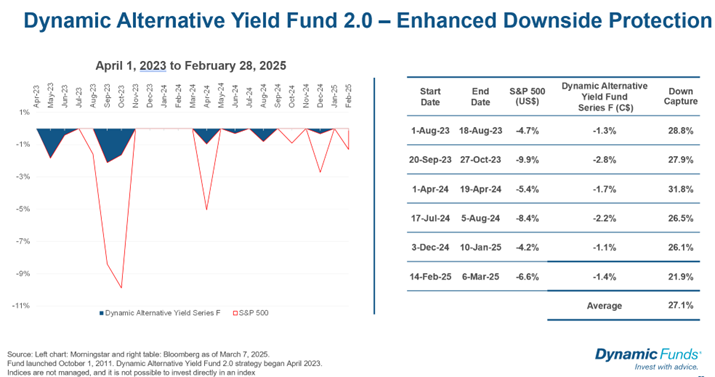

As evidenced on the chart above, the portfolio diverges significantly from traditional balanced funds and functions as an effective diversifier within an account. Investors should also be aware that these since strategies can behave differently from traditional assets, they may not perform as expected in all market environments. Historically the fund’s consistently robust performance is demonstrated by the comparative analysis below, which contrasts the distribution curve of its weekly returns with that of the S&P 500 Index.

Fig 1. DAYF_Q1_25 Commentary - Investing Lessons from Golf's Most Consistent Driver

Please note that, past performance is not indicative of future results, and investors should consider both the potential benefits and risks when evaluating such strategies.

Emphasizing the importance of safeguarding portfolios through defensive hedges, a commitment to consistent returns, and a focus on risk-adjusted performance, Alternative Yield has demonstrated considerable resilience. Since its strategic repositioning in 2023—marked by the appointment of a new lead portfolio manager and adjustments in response to rising interest rates—the fund has consistently proven its ability to navigate down markets with strength. That said, no investment strategy can eliminate risk, and performance may vary depending on market conditions.

If you would like to explore whether this type of investment aligns with your financial goals and risk tolerance, we welcome the opportunity to provide more information and answer your questions.

This e-newsletter has been prepared by David Novak and expresses the opinions of the author and not necessarily those of Raymond James Ltd. (RJL). Statistics, factual data and other information are from sources RJL believes to be reliable, but their accuracy cannot be guaranteed. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. This newsletter is intended for distribution only in those jurisdictions where RJL and the author are registered. This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same privacy policy which Raymond James Ltd adheres to. Securities-related products and services are offered through Raymond James Ltd., member-Canadian Investor Protection Fund. Insurance products and services are offered through Raymond James Financial Planning Ltd. (“RJFP”), a subsidiary of Raymond James Ltd., which is not a Member - Canadian Investor Protection Fund.