Our core beliefs Don't chase trends, make plans

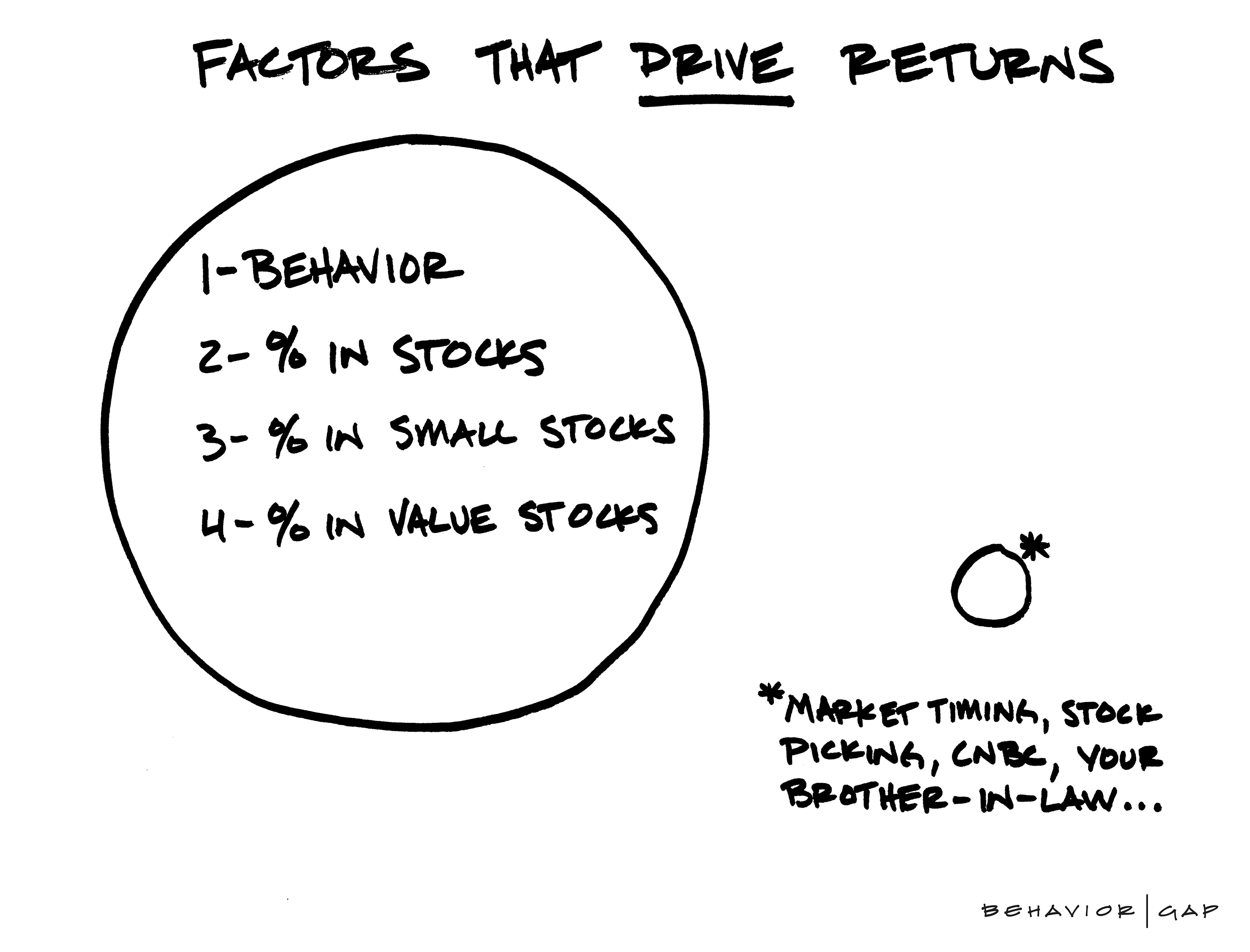

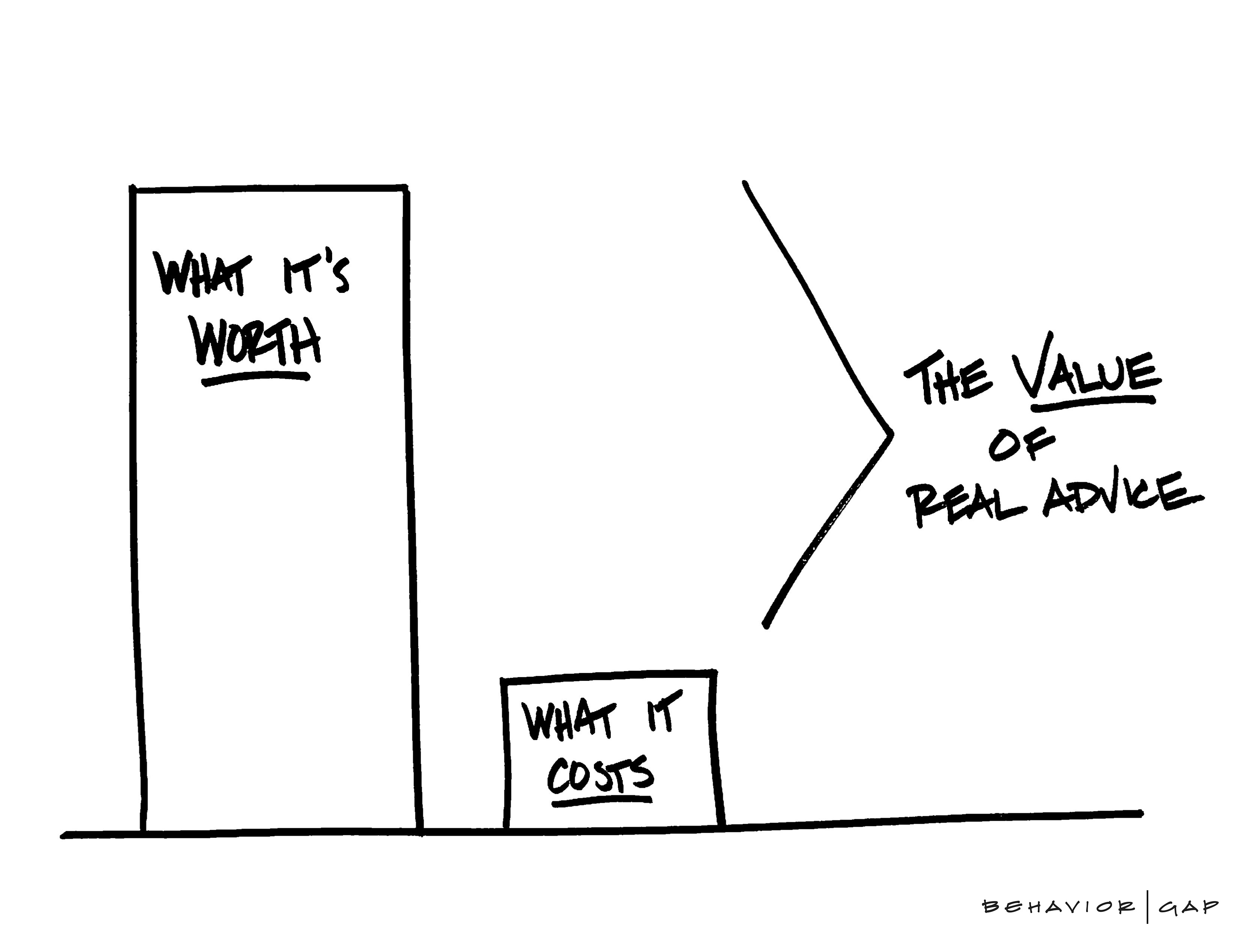

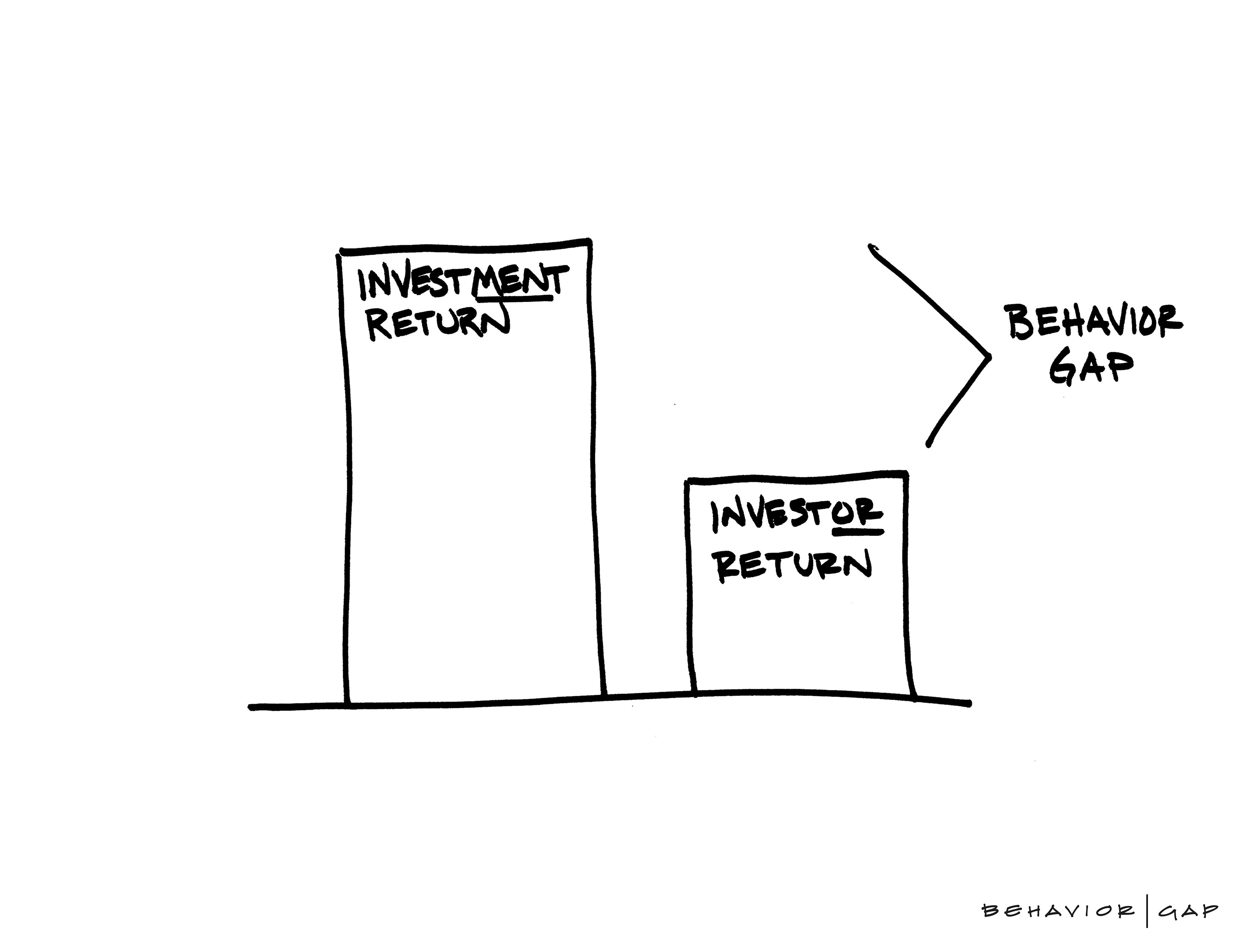

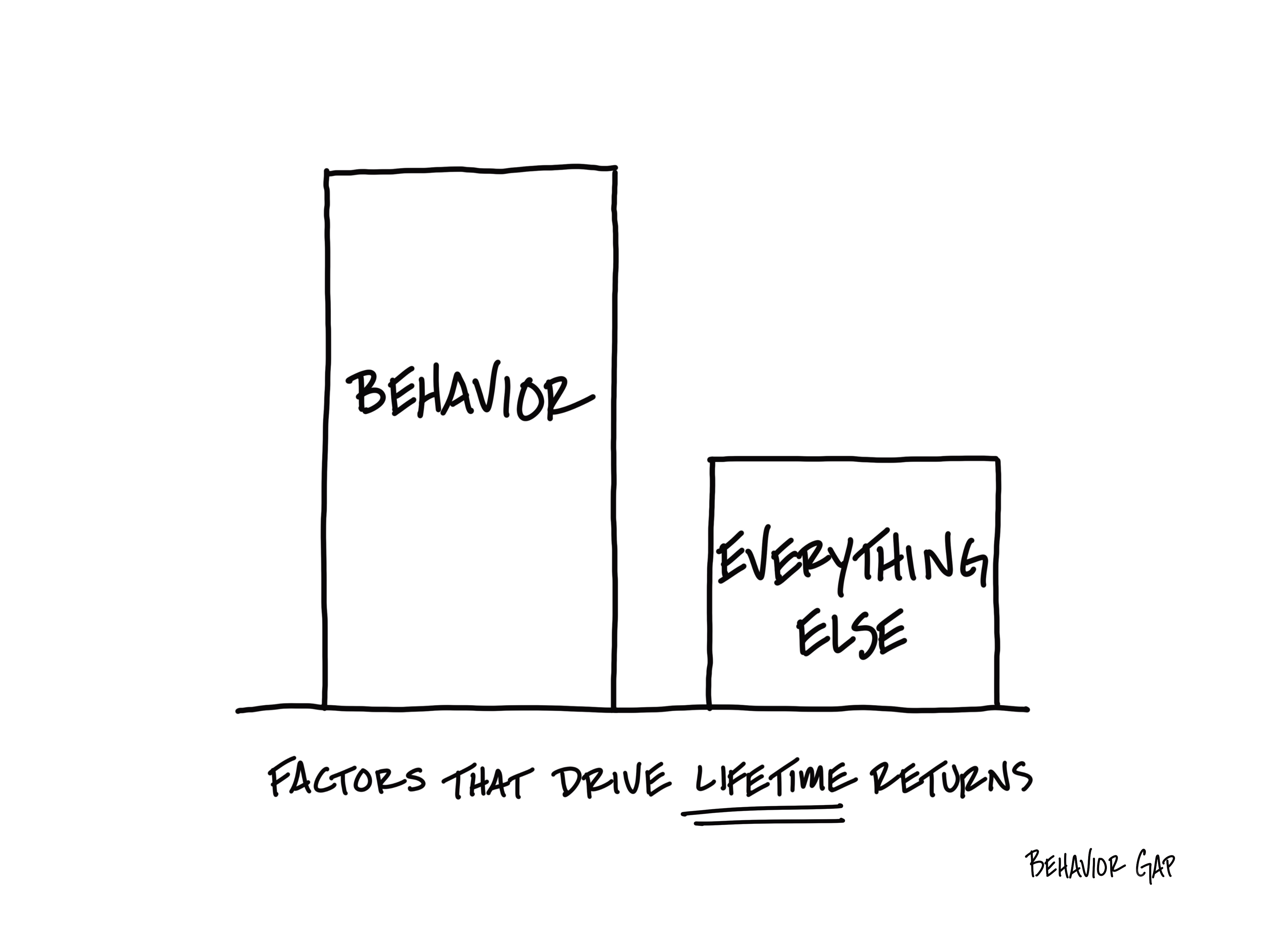

We believe financial performance is determined by investor behaviour, not product selection. Whether we admit it or not, emotions have a significant impact on our investment decisions. Carl Richards explains it best in his book, The Behavior Gap. We tend to blame a volatile financial market for any losses, but actually, it’s our decisions which are the problem. The gap between what we should do and what we actually do is what we need to address in order to make (and repeat) sound financial investments.

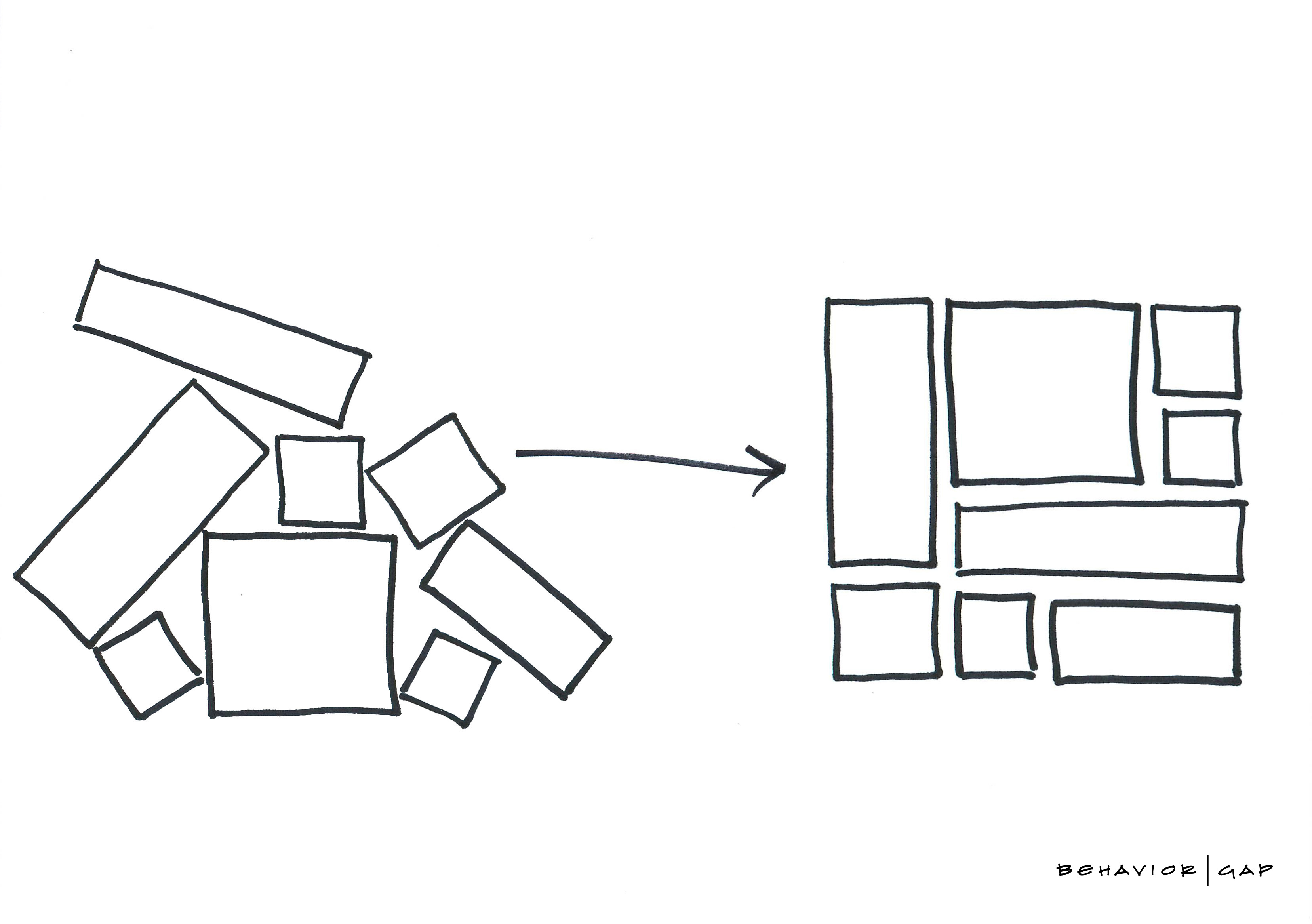

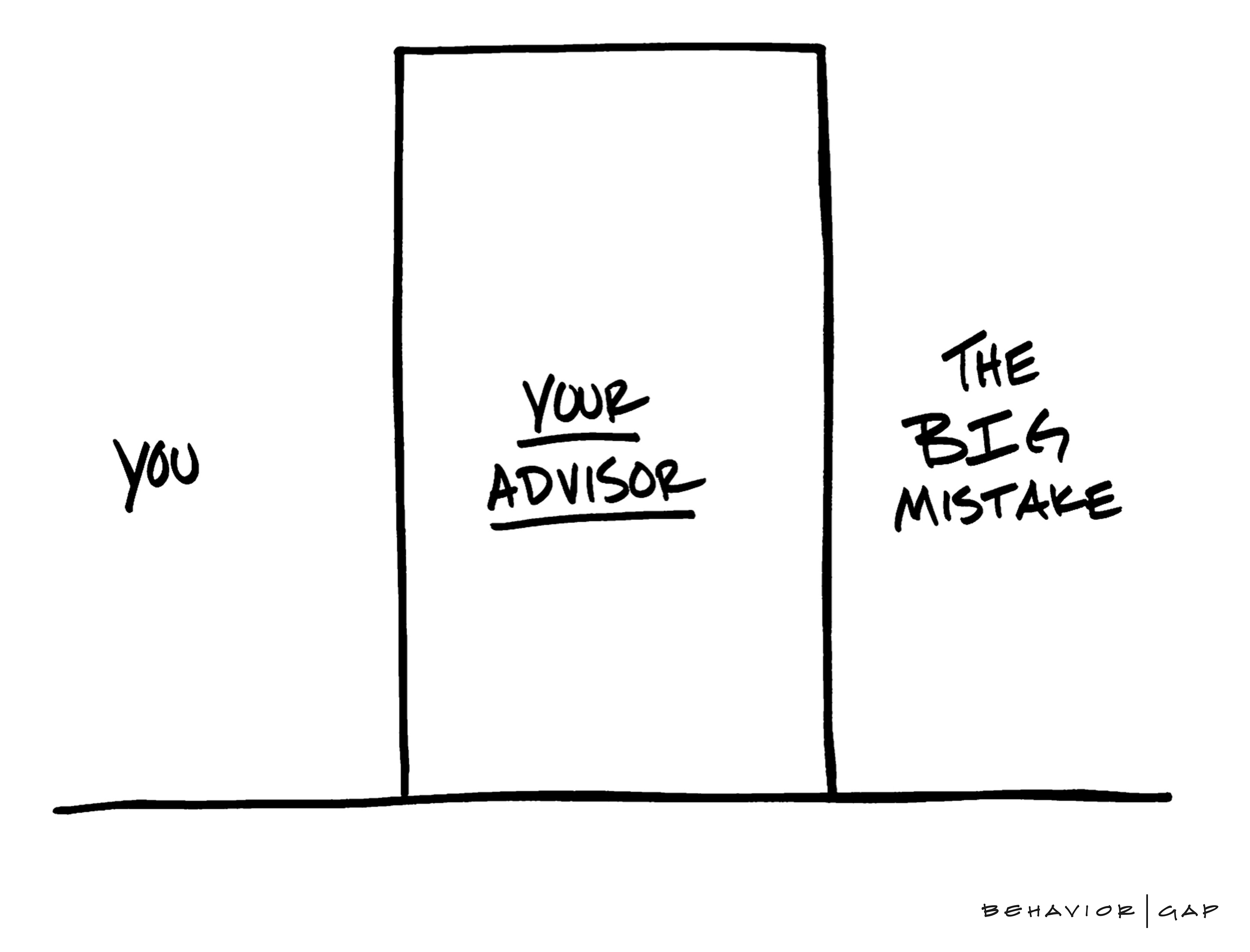

That’s why we spend time with our clients understanding their hopes and fears and introducing them to healthy investor behaviours. The result is a robust behavioural investment strategy. With us as their financial mentors, our clients stop reacting to outside influences, learn to run their own race and avoid big financial mistakes.

Our guiding principles:

- Performance is determined by investor behaviour, not product selection.

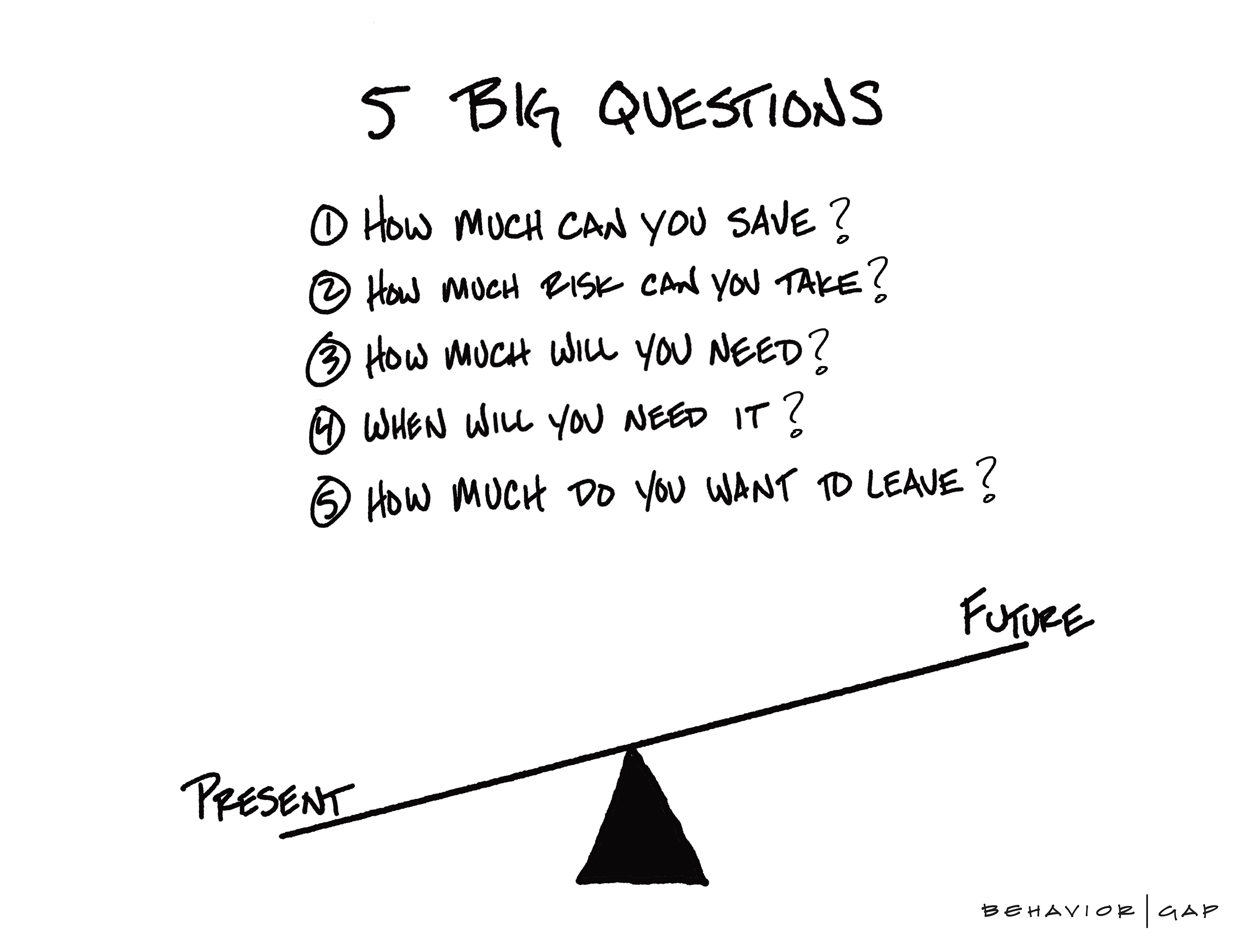

- Discipline and a written financial plan improve your ability to achieve real financial goals.

- Equity ownership is the only way to ensure inter-generational wealth.

- Asset allocation, not stock picking, is responsible for 90% of long-term investment success.

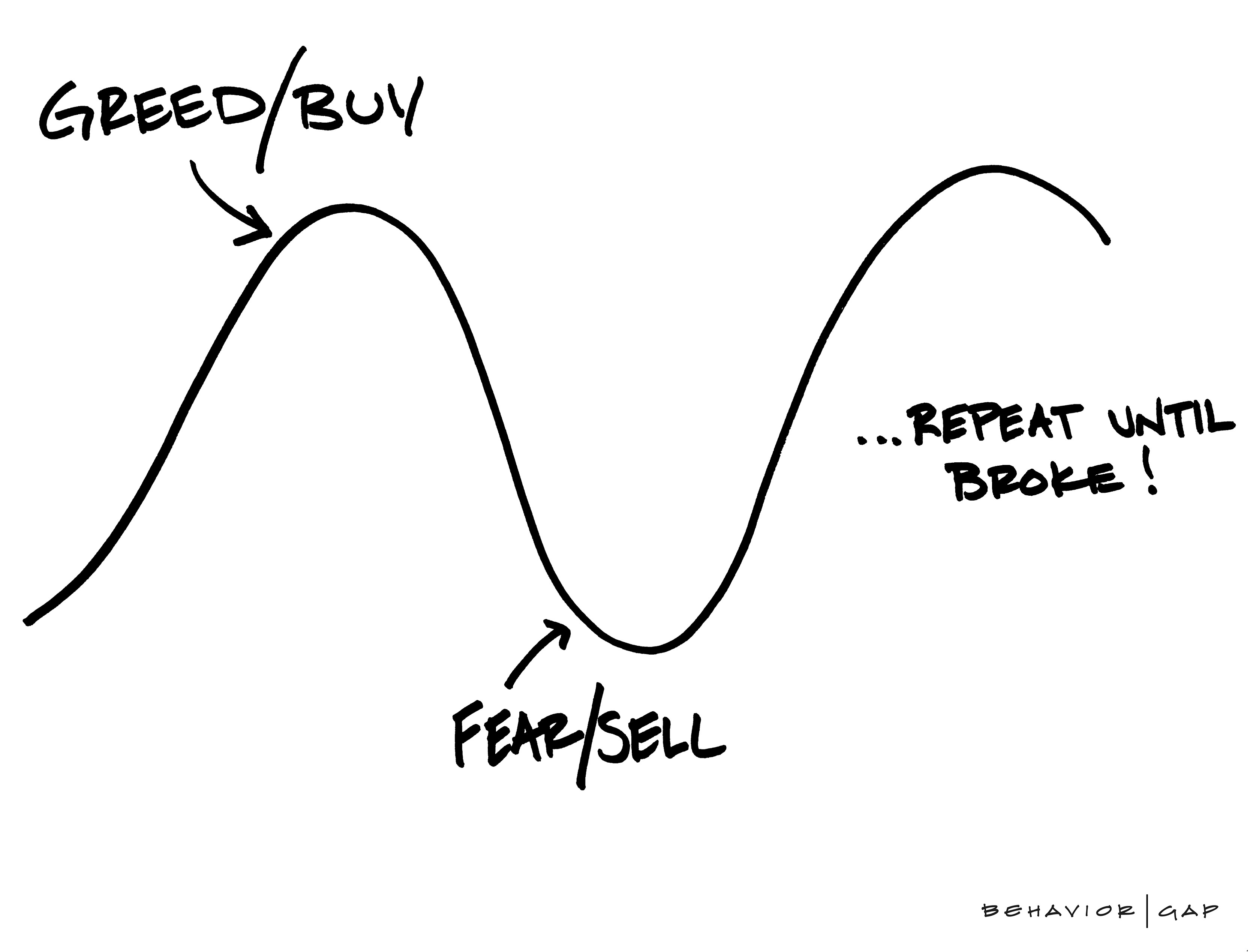

We're wired to avoid pain and pursue pleasure and security. It feels right to sell when everyone around us is scared and buy when everyone feels great. It may feel right-but it's not rational.

Carl Richards, The Behavior Gap