The Complete 2026 TFSA Guide

Since launching in 2009, the Tax-Free Savings Account has become the cornerstone of Canadian wealth building. Yet surveys show many Canadians aren't maximizing its incredible potential.

If you're not using your TFSA to its fullest, you're missing out on what many consider the best financial product the government has ever created.

TFSA Fast Facts for 2026:

- Annual Contribution Limit: $7,000 (2026)

- Total Contribution Room: $109,000+ (if eligible since 2009)

- Tax on Growth: $0 forever

- Tax on Withdrawals: $0 forever

- Investment Options: Stocks, bonds, ETFs, mutual funds, GICs, cash

- Withdrawal Flexibility: Anytime, any reason, no penalties

What Makes the TFSA So Powerful?

The TFSA combines ultimate flexibility with tax-free growth:

✅ Tax-Free Growth Forever

- No tax on interest, dividends, or capital gains

- Growth compounds without tax drag

- Withdraw gains tax-free anytime

✅ Ultimate Flexibility

- Withdraw anytime for any reason

- No penalties or restrictions

- Contribution room restored following year

✅ No Age Restrictions

- Contribute from 18 until death

- No mandatory withdrawals ever

- Pass to spouse completely tax-free

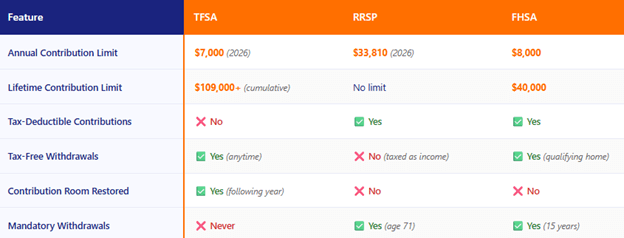

TFSA vs. RRSP vs. FHSA: Complete Comparison

TFSA/RRSP/FHSA - 2026

Which Account is Best For:

- Flexibility & Tax-Free Growth = TFSA

- Retirement & Tax Deductions = RRSP

First Home Purchase = FHSA

TFSA Calculator: How Much TFSA Contribution Room Do You Have?

Your total room depends on when you became eligible (age 18 and Canadian resident):

Eligible Since 2009: $109,000 total room

Eligible Since 2015: $78,000 total room

Eligible Since 2020: $45,500 total room

Born in 2008: $7,000 room (first year of eligibility)

Common Costly Mistakes:

1. Over-Contributing: Results in 1% monthly penalty on excess.

2. Immediate Re-Contribution: Must wait until Jan 1st of next year to restore room

3. Day Trading Classification: CRA may tax gains if considered business

4. Foreign Investments Within TFSA: Foreign dividends face 15-30% withholding tax

5. Not Maximizing Room: Unused room compounds to massive opportunity cost

6. Leaving Canada: No longer eligible to contribute, results in 1% penalty on non-resident contributions.

Real-World Impact: The Power of Tax-Free Compounding

Case Study: Sarah, age 25, maximizes TFSA annually

- Annual contributions: $7,000 on January 1st

- Average return: 6% annually

- Age 65 result: ~$1.2 million, completely tax-free

TFSA for Every Life Stage

✅Young Adults (18-30): Focus on building emergency fund, then growth investing

✅Career Building (30-45): Balance competing priorities, maximize growth potential

✅Peak Earning (45-60): Coordinate with RRSP, prepare for retirement transition

✅Retirement (60+): Typically recommended to keep money within TFSA – use government pensions first, then RRSPs (generally speaking)

International Considerations:

✔️Non-Residents: Can keep existing TFSA but cannot make new contributions

✔️Returning Residents: Resume contributions based on years of Canadian residency

✔️Estate Planning: Spouse can inherit TFSA tax-free if listed as ‘Successor Annuitant’; beneficiaries receive value but not contribution room

✔️Foreign Country Taxation: Any income earned or distributions may be taxable if you are a tax resident of another country.

Getting Started: Your TFSA Action Plan

1. Start with Emergency Fund: Build 3-6 months’ expenses in high-interest savings first

2. Calculate Your Room: Check CRA MyAccount or your accountant for exact TFSA room

3. Choose Your Provider: Compare services, fees and investment options

4. Begin Investing: Start with low-cost index funds for long-term goals

5. Automate Contributions: Set up monthly transfers to maximize room, or contribute maximum amount each January to maximize growth

6. Annual Review: Rebalance and assess strategy annually

Frequently Asked TFSA Questions:

1. How much can I contribute to my TFSA in 2026 if I've never contributed before?

If you've been eligible since 2009 (age 18+), your total TFSA contribution room for 2026 is $109,000. This includes the $7,000 limit for 2026 plus all unused room from previous years. If you became eligible later, your room starts from the year you turned 18. You can check your exact contribution room on your CRA MyAccount or call 1-800-267-6999.

2. Can I re-contribute money I withdraw from my TFSA in the same year?

If you have a maxed out TFSA and withdraw money this year, you must wait until January 1st of the following year to regain that contribution room. For example, if you withdraw $5,000 in June 2025, you can only re-contribute that $5,000 starting January 1st, 2026. Immediate re-contribution without available room results in over-contribution penalties. If you have additional contribution room when you withdraw, be sure to not over-contribute. Check with your advisor or accountant to ensure you’re not incurring any penalties with your strategy.

3. What happens if I accidentally contribute more than my TFSA limit?

You'll face a 1% monthly penalty on the excess amount for every month it remains in your account. For example, if you over-contribute by $3,000, you'll pay $30 per month ($360 per year) until you withdraw the excess. The CRA will send you a notice, and you should remove the excess immediately to minimize penalties.

4. Should I hold U.S. stocks in my TFSA or RRSP?

RRSPs are generally better for U.S. dividend stocks because U.S. dividends in RRSPs face 0% withholding tax due to the Canada-U.S. tax treaty, while TFSA accounts face 15% withholding tax on U.S. dividends. However, for U.S. growth stocks with minimal dividends, TFSAs offer completely tax-free capital gains. Consider your investment timeline and dividend vs. growth strategy.

5. Can I use my TFSA for day trading or running a business?

Be very careful. If the CRA determines your TFSA activity constitutes carrying on a business (frequent trading, short holding periods, specialized knowledge), they may tax all gains as business income and remove the tax-free status. Stick to long-term investing strategies to maintain your TFSA's tax-free benefits. Consult a tax professional if you're an active trader.

Ready to master your TFSA strategy? The earlier you start, the more powerful the compound growth becomes. Contact us today for a free review.

#PersonalFinance #FinancialPlanning #TFSA #RRSP #FHSA #CanadianFinance #RetirementPlanning #FinancialLiteracy #TaxStrategy #TFSA2026

This article is for educational purposes only and does not constitute financial advice. Consult qualified professionals for personalized retirement planning.

Last updated: October 2025