Cross-Border Clients

We help Americans and Canadians who find themselves in the unique situation of having investment accounts on both sides of the border. Whether you are a Canadian resident moving to the US, an American living in Canada, or a US resident who expects to inherit Canadian dollars, we can help.

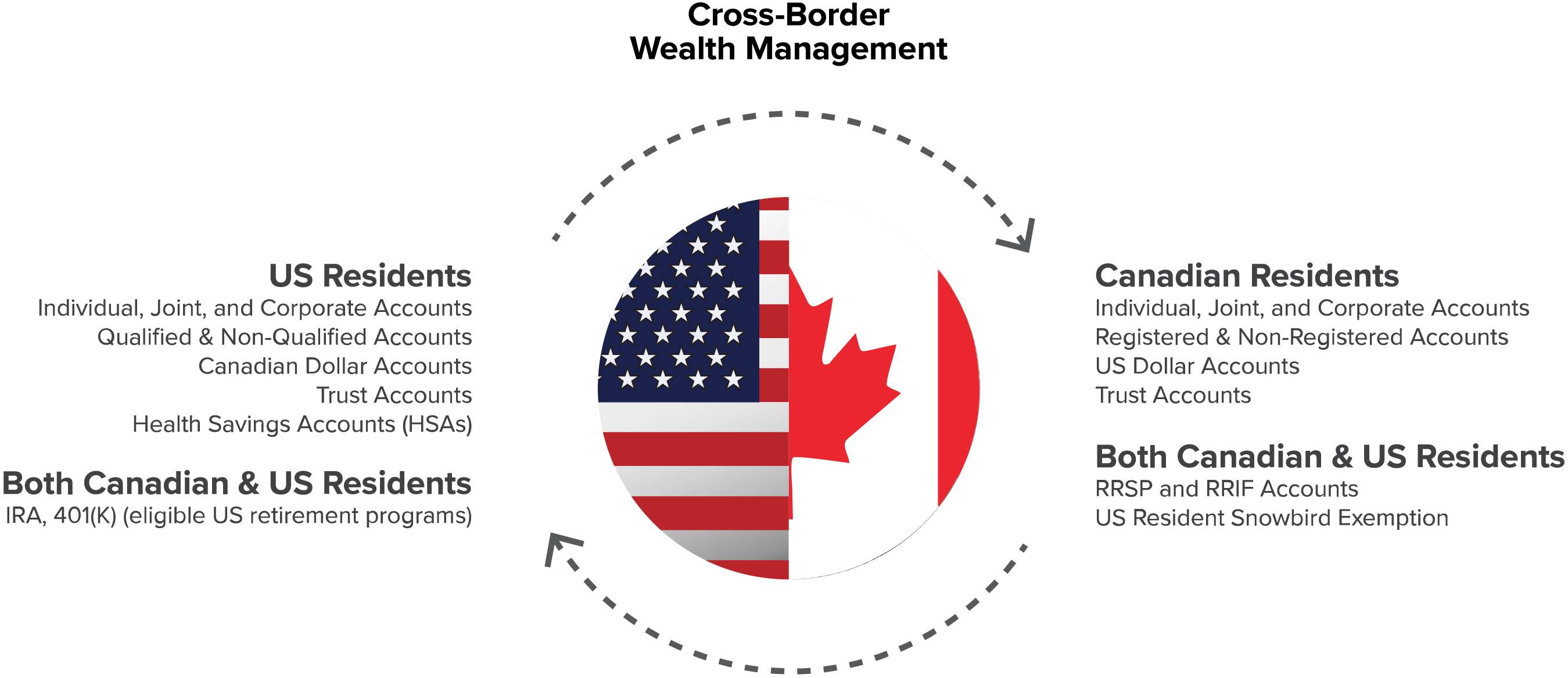

We are currently one of the only retail investment advisory practices in Atlantic Canada that is licensed and capable of servicing accounts on both sides of the Canada/US border. We are affiliated with both Raymond James Ltd (Canada) and Raymond James USA Ltd (US) and have all of the necessary individual registrations and licensing to deal with all account types and situations that might arise from US residents moving to Canada, or Canadian residents moving to the US (permanently or temporarily). Your accounts will all stay with us, within Raymond James, and will be managed efficiently according to the appropriate Canadian/US financial, tax, and regulatory systems.

-

Canadians tend to move to the United States to try to escape the cold or to follow an employment opportunity. When they do, they can find themselves in the unfortunate situation of being 'orphaned' by their existing Canadian based investment advisor as most Canadian investment advisory firms are not properly registered to do business with Canadians in the United States.

-

An American living in Canada can end up in the unfortunate situation of being 'orphaned' by their existing U.S. based advisor as most U.S. broker dealer and investment advisory firms are not properly registered to do business in Canada.

-

Inheriting money from a Canadian relative? The weakness in the Canadian dollar versus the U.S. dollar can mean you will be in the unfortunate situation of receiving 15–25% less than you thought your inheritance would be. We can assist you by creating a disciplined investment strategy in Canadian dollars, and when there is a better time or a particular need for U.S. dollars, we can handle the foreign exchange conversion for you.

We are licensed and regulated in both Canada and the U.S., and work closely with clients to translate their personal needs into a strategy for their cross-border accounts. We can also advise clients on cross-border issues such as PFIC rules, IRA and 401(k) rollovers and we maintain professional networks to assist with planning, taxation and legal services.

FAQ

Americans Living in Canada

-

No. The equivalent in Canada to a 401(k) plan is a Registered Retirement Savings Plan (RRSP). You cannot "roll over" 401(k) and IRA accounts into RRSPs without first collapsing the account and taking potentially high taxes and penalties.

-

Most U.S. brokerage firms cannot hold 401(k)s or IRAs for people residing in Canada. But Raymond James (USA) Ltd. can. We can help you maintain these accounts, so you won't have to collapse or liquidate them, actions that risk significant penalties or tax consequences.

-

Most U.S. brokerages will give 30, 60 or 90 days for clients to move their assets to an eligible firm. But others may sell off invested assets at the current market value and simply send a cheque for the balance, potentially leading to significant penalties or tax consequences.

-

Yes. Our advisors are dually licensed to work with U.S.- and Canada-based clients and investment assets.

-

We can help you open an account appropriate for your loved one's gift that is consistent with your financial goals and is informed by the tax implications of the benefit.

Canadians living in the U.S.

-

No. In the U.S., a 401(k) plan and individual retirement account (IRA) are similar to an RRSP. However, you cannot "roll over" an RRSP into a 401(k) plan or IRA without first liquidating the RRSP, an action that could trigger significant penalties and taxes.

-

If you are a Canadian who moved to the U.S., you may be able to leave your RRSP in the hands of your Canadian brokerage, though the account may need to be self-directed. This means you would need to make all the investment decisions for your RRSP without the guidance of a financial advisor or investment manager. That's where we can help. Under our affiliation with Raymond James (USA) Ltd., we can hold your account and still provide ongoing investment guidance.

-

RRSPs and TFSAs can create complex situations for taxpaying residents of the U.S. We can provide guidance on how to manage those issues.

Canadian cash accounts can, in many cases, simply be moved to a U.S.-licensed firm. However, different actions may be required based on the types of assets. We can help you understand your choices and make decisions suitable for your personal situation and financial goals.

-

Yes. Our advisors are dually licensed to work with Canada- and U.S.-based clients and investment assets.

-

We can help you open an account appropriate for your loved one's gift that is consistent with your financial goals and is informed by the tax implications of the benefit.

Cross-border Solutions

Part of the Raymond James Financial family of companies, Raymond James (USA) Ltd., or RJLU, is a Canada-based US registered investment firm offering integrated cross-border wealth management solutions to Americans living in Canada and Canadians living in the US. As RJLU advisors, we are licensed and regulated in both Canada and the US, and work closely with clients to translate their personal needs into a strategy for their cross-border accounts. We also advise clients on cross-border issues, such as Passive Foreign Investment Company (PFIC) rules and IRA rollovers, and maintain professional networks to assist with planning, taxation and legal services, as required.

RJLU enables US resident clients to hold both Canadian and US currency accounts. This allows Canadian equities and Canadian dollar denominated fixed income to be added to client portfolios without having to settle in US currency, thus avoiding foreign exchange spreads. US clients can gain expert access to quality Canadian investment grade instruments with our assistance.

How Does Biscop Cross Border Investment Services Help?

First, Raymond James (USA) Ltd., "RJLU", unlike most investment firms registered with FINRA and the SEC, operates in and across Canada. RLJU is a subsidiary of Raymond James Financial (NYSE:RJF) and has completed an exemption from registration application in Canada to be able to help American citizens living across Canada.

Second, we at Biscop Cross Border Investment Services are registered as advisors in both Canada and the United States. We understand the challenges that the cross-border American citizen faces and have strong connections with other cross-border professionals in areas like tax, trust and estate planning, and insurance and immigration.

By being registered in both countries and well connected to other cross-border centers of influence, we can offer you more than just a Canadian wealth management solution. We can offer you a holistic wealth management solution and coordinate your entire portfolio of assets to keep you on track to achieving your financial goals.

Some of the accounts we manage for clients include:

- RRSPs and RRIFs for Canadians living in the US.

- IRAs for Americans living in Canada.

- Investments for Americans wanting Canadian securities.

- Investment accounts for US-resident children of Canadian-resident parents.