Life Insurance 101: What You Need, What You Want, and What to Choose

Welcome back! It's been a while—three years, in fact—since our last newsletter. We're excited to reconnect and bring you fresh insights on financial planning, starting with a timely look at life insurance. Thank you for staying with us!

The Purpose of Life Insurance: Need vs. Want

At its core, life insurance is a financial safety net. It ensures that your loved ones are protected from financial hardship if you pass away unexpectedly. But the need for life insurance varies depending on your life stage, financial obligations, and long-term goals.

- You need life insurance if others depend on your income—spouse, children, aging parents, or even business partners.

- You may want life insurance for estate planning, tax advantages, or to leave a legacy—even if no one is financially dependent on you.

Term Life Insurance: Affordable Protection for a Defined Period

Term life insurance is the simplest and most affordable form of life insurance. It provides coverage for a specific period—typically 10, 20, or 30 years. If you die during the term, your beneficiaries receive the death benefit. If you outlive the term, the policy expires with no payout.

Benefits of Term Life Insurance:

- Affordability: Premiums are significantly lower than permanent insurance for the same coverage amount.

- Simplicity: Easy to understand and manage.

- Customizable terms: Choose a term that aligns with your financial responsibilities.

Who Should Consider Term Insurance?

- Young families

- New homeowners

- Budget-conscious individuals

Downsides:

- No cash value accumulation.

- Coverage ends after the term unless renewed.

Permanent Life Insurance: Lifelong Coverage With a Cash Value Component

Permanent life insurance—whole life, universal life, and variable life—offers lifelong coverage and includes a savings or investment component known as cash value. A portion of your premium goes into this cash value, which grows over time and can be borrowed against or withdrawn.

Benefits of Permanent Life Insurance:

- Lifelong protection

- Cash value accumulation

- Estate planning tool

Who Should Consider Permanent Insurance?

- High-net-worth individuals

- Business owners

- People with lifelong dependents

- Those seeking forced savings

Downsides:

- Cost

- Complexity

- Lower returns

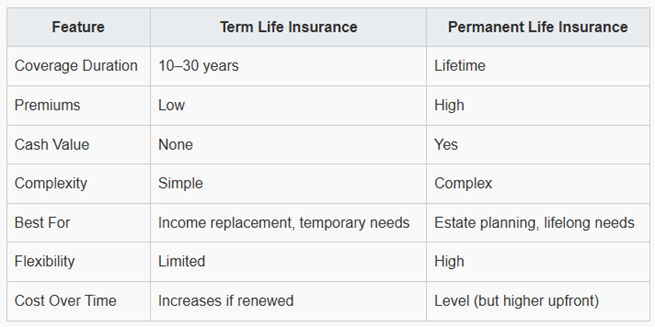

Term vs. Permanent: A Side-by-Side Comparison

Making the Right Choice: What’s Best for You?

Choosing between term and permanent insurance isn’t just about cost—it’s about aligning your coverage with your goals.

Ask yourself:

- Do I have dependents who rely on my income?

- Do I want to leave a financial legacy or cover estate taxes?

- Can I afford higher premiums for long-term benefits?

- Do I need insurance for a specific period or for life?

For most people, term insurance is the right starting point. However, permanent insurance can be a powerful tool for those with more complex financial needs.

Pro Tip: Consider a Hybrid Approach

Many advisors recommend a laddered or blended strategy—starting with term insurance when your needs are highest and later converting part of it to permanent insurance.

Some term policies offer conversion options, allowing you to switch to permanent coverage without a medical exam.

Final Thoughts: Insurance as a Financial Foundation

Life insurance isn’t just about death—it’s about life. It’s about protecting the people and goals that matter most to you. Whether you choose term, permanent, or a combination of both, the key is to make an informed decision based on your unique circumstances.

Remember: the best policy is the one that’s in place when you need it.

Thank you for taking the time to read this edition of our newsletter. We hope it’s given you valuable insight into the world of life insurance and helped clarify the differences between term and permanent coverage. Whether you're planning for your family's future or building a long-term financial strategy, the right insurance can be a powerful foundation.

If you have any questions or would like to explore your options further, don’t hesitate to reach out.

Until next time,

Nathan Biren

This newsletter has been prepared by Nathan Biren and expresses the opinions of the author and not necessarily those of Raymond James Ltd. (RJL). Statistics, factual data and other information are from sources RJL believes to be reliable but their accuracy cannot be guaranteed. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. This newsletter is intended for distribution only in those jurisdictions where RJL and the author are registered. Securities-related products and services are offered through Raymond James Ltd., member Canadian Investor Protection Fund. Insurance products and services are offered through Raymond James Financial Planning Ltd., which is not a member-Canadian Investor Protection Fund.