Market Timing – Why It’s a Terrible Hobby

Let’s be honest for a second. We, as a species, can’t even time the ripeness of an avocado (if you can please DM me, you’ll save me tons!). Everybody thinks they can time the market perfectly. It’s as if we are all sitting in front of 16 computer monitors like we’re running a hedge fund out of a bunker.

Salty take – you are NOT watching the markets 24/7. On that note, even I am not watching them 24/7. And I literally WORK in wealth management. In case you think I’m staring at the S&P 500 every second of the day, please think of the meetings you’ve had with me during business hours, where I was not, in fact, checking anything anywhere.

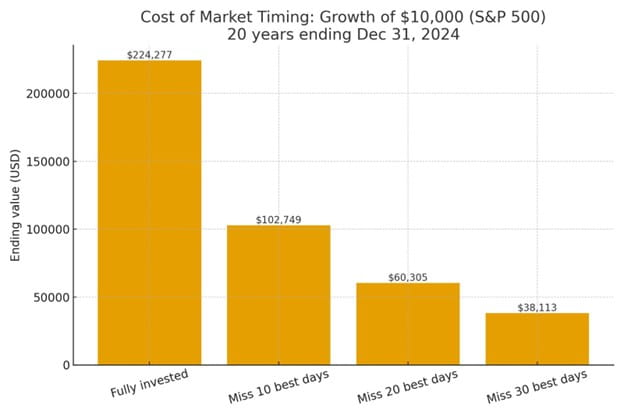

Research has shown that missing just a handful of the market’s best days can turn your portfolio into a sad wilted plant that didn’t get watered. Here’s what happens to $10,000 over 20 years, if you miss the best 10 days.

Yes…missing 10 days in 20 years (that’s 7300 days, in case math isn’t your thing today) cuts your return by more than half.

I’ve heard a lot of confident clients tell me, “I’ll get back in once things look better.” Good solution, right? WRONG. Markets, unfortunately, don’t send calendar invites prior to announcing their best days. They show up unannounced (often on the heels of very bad days). Panic selling usually locks in losses and skips the rebound.

It’s hard to time things. Haircuts, leaving the house “early” only to still arrive late, etc. If we can’t even time our own daily lives, why would we think we can time global financial markets that are influenced by millions of people, AI, geopolitics, inflation, corporate earnings, and that one guy we call Jerome Powell.

A MUCH healthier, less stressful, and more sleep-friendly strategy (for both of us) is: stay invested. Diversify. Add regularly. Take a walk. Drink water. Stop refreshing your portfolio like it’s your ex-situationship’s IG story. Long-term investing works. Timing the market doesn’t. If anyone claims they can perfectly predict the market, you should ask them why they’re still working. To a good financial future!