Market Update: Concentration, Rotation and Opportunity

Stay Selective: Stay Diversified

Markets continued their ascent in August and have faced very little resistance since early April. The S&P500 has completed its best five-month run since the post-pandemic rebound and is enjoying its longest stretch without a 3% pullback in nearly two years, driven largely by enthusiasm around AI and infrastructure spending. At the same time, valuations have broadened beyond the large tech names, with small and midcap companies starting to participate more meaningfully in the rally. Historically, surges of this magnitude have often marked the beginning of durable bull markets. While this momentum is encouraging, it is important to be mindful of the fact that an increase in market volatility can occur without notice, leading to a corrective phase. This is why we always favour diversification over concentration and owning a mix of both dividend and growth stocks.

Bank of Canada Joins the Fed in Cutting Rates

This week, the Bank of Canada lowered its key interest rates to 2.5%, its first cut since March. The move comes amid a softening job market, easing inflation pressures and the removal of retaliatory tariffs against the U.S. While consumer spending has held up, the Canadian economy has lost over 100,000 jobs in the past two months, and uncertainty around U.S. trade policy continues to weigh on business investment. While further cuts are possible, the Bank is not forecasting a recession, unless U.S. tariffs escalate further. South of the border, the Fed also cut rates by 25bps this week, with Chairman Powell calling it a “riskmanagement rate cut.” This shift toward accommodation could provide a tailwind for equities, especially if the economy remains resilient.

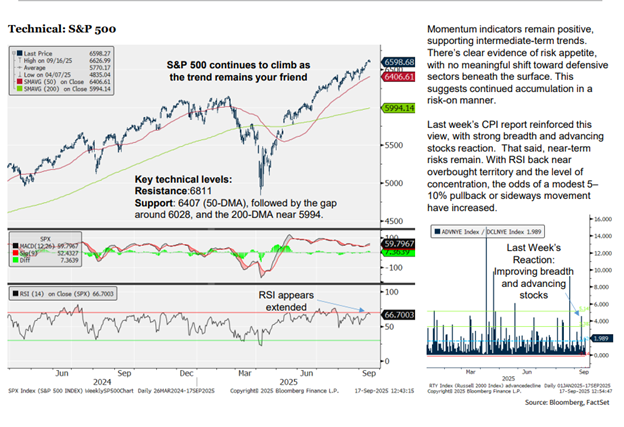

Let’s Get Technical

While momentum remains strong, we’re seeing signs that the market may be due for a pause or a short term pullback. There’s no meaningful shift toward defensive sectors, reinforcing investor appetite for growth. However, with RSI nearing overbought territory and market concentration at cycle highs, the odds of a 5–10% pullback or sideways movement have increased. Key levels to watch on the S&P 500 include resistance at 6811, support at 6407 (50-DMA), and deeper support near 5994 (200-DMA).

Bottom Line

The trend remains your friend, but selectivity and discipline are essential. Pullbacks are always possible, especially with tariff risks still looming. We view any periods of weakness as opportunities to accumulate quality positions, particularly outside of the crowded tech trade. Your unique circumstances and risk tolerance are key factors in the ongoing management of your portfolio. To discuss how this or other financial opinions may affect your investments, please don’t hesitate to contact me.

Sincerely,

Marc Latta

Senior Financial Advisor

This newsletter expresses the opinions of the writer, Marc Latta, and not necessarily those of Raymond James Ltd. (RJL). Statistics and factual data and other information are from sources believed to be reliable, but their accuracy cannot be guaranteed. It is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. It is not meant to provide legal, taxation, or account advice; as each situation is different, please seek advice based on your specific circumstance. RJL and its officers, directors, employees and their families may from time to time invest in the securities discussed in this newsletter. It is intended for distribution only in those jurisdictions where RJL is registered as a dealer in securities. Any distribution or dissemination of this newsletter in any other jurisdiction is strictly prohibited. This newsletter is not intended for, nor should it be distributed to any person residing in the USA. Raymond James Ltd is a member of the Canadian Investor Protection Fund. Please note that when borrowing to invest you will need to ensure that you have adequate financial resources to meet your loan obligations. This provides links to other Internet sites for the convenience of users. Raymond James Ltd. is not responsible for the availability or content of these external sites, nor does Raymond James Ltd endorse, warrant or guarantee the products, services or information described or offered at these other Internet sites. Users cannot assume that the external sites will abide by the same Privacy Policy which Raymond James Ltd adheres to.