Insights and Strategies

March Madness

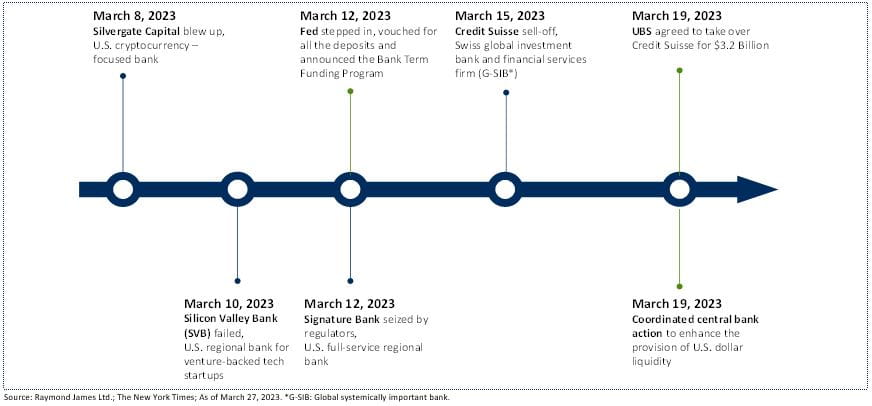

The Fed has, historically, tightened until something breaks, so we suppose we can declare mission accomplished after the Silicon Valley Bank (SVB) and Signature Bank failures.

The failure of SVB, which marks the second-largest bank failure in U.S. history, unnerved many U.S. regional bank deposit holders and shareholders. U.S. regional banks experienced deposit outflows, while large money-centred banks like JPMorgan and Bank of America experienced inflows. The iShares U.S. Regional Banks ETF slipped over 30 per cent in March.

To stem the flow of deposits and avoid additional bank failures, the Fed stepped in to provide liquidity by announcing a new emergency lending program, the Bank Term Funding Program (BTFP), designed to ease pressure on the banking system. In addition, the U.S. treasury department implicitly suggested all regional deposits were safe, though Yellen would later walk back any explicit government guarantee of uninsured deposits.

There are a few takeaways from SVB’s failure. First, SVB was somewhat of a unique situation and offered a lesson on why diversification is a key ingredient in mitigating risk. SVB focused on cash-hungry technology start-ups that needed their money on demand. Unfortunately, SVB invested the majority of those cash deposits in long-dated bonds. This ended up being a toxic combination or, in industry terms, a mismatch between assets and liabilities.

To meet the shortfall, SVB unloaded long-dated U.S. treasury bonds at a significant loss, which spooked deposit holders and caused a run on the bank. While U.S. treasuries are a safe investment, bonds with longer terms to maturity may see larger price fluctuations.